Turkey joins ‘Super League’ as gaming startups shine in record Q1

As capital continues to pour in at an unprecedented pace, the Turkish startup ecosystem has left behind its best first quarter to date.

The momentum promoted Turkey to the “Super League” in Europe when it comes to investments, while Istanbul spearheaded the way with the gaming industry.

The Turkish startups secured more than $1.27 billion in 49 investment rounds from January through March, the data from the industry monitor startups.watch showed.

It has approached the amount of the whole of 2021, when over $1.58 billion was invested through a total of 321 tours.

The January-March figure marks the best first quarter ever for the ecosystem, and would still be the highest to date ($505 million) if the investment that the rapid delivery pioneer Getir has received is excluded.

Most of the capital, namely 90% or over $1.14 billion, poured into three startups alone. Getir secured $786 million, followed by Dream Games with $255 million and Insider with $121 million, the startups.watch data showed.

Turkey has thus on a quarterly basis managed to find itself in the league of billion-dollar countries, named the “Super League,” consisting of nations such as the United Kingdom, France and Germany.

Istanbul champion

Turkey has been a champion in gaming investments, said startups.watch founder Serkan Ünsal.

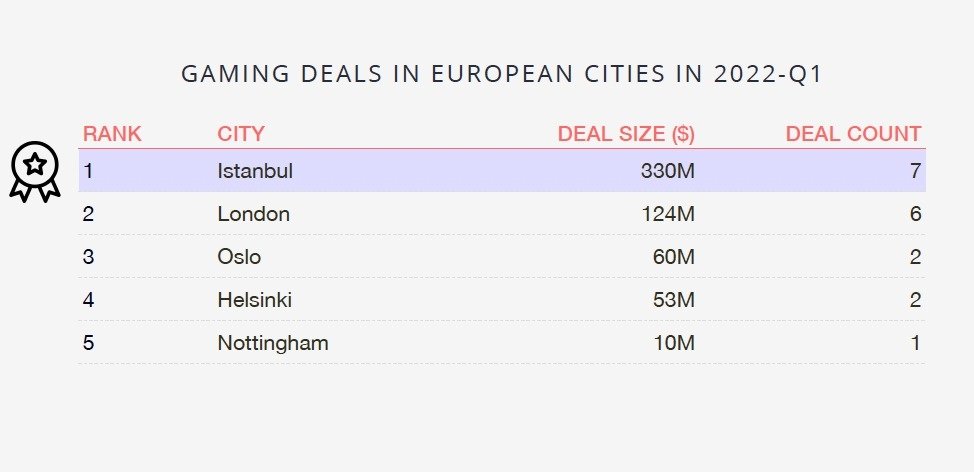

“Considering the investments made in gaming initiatives in the first quarter of 2022, Turkey became the country attracting the most investments in Europe and the Middle East region, while Istanbul became the city drawing the largest amount of investments,” Ünsal told the event to announce the first-quarter results.

The Turkish metropolis thus left behind prominent cities such as London, Oslo and Helsinki, he added.

“Istanbul, which also ranks first in terms of the number of game studios, has clinched its breakthrough in gaming,” Ünsal stressed.

“Gaming startups set a record as the total amount of investments, and in the first quarter, seven startups received investments of $326 million.”

Ünsal stressed the performance of Spyke Games, which raised a record $55 million in a seed round of funding. It marks the largest seed round to date for a startup out of Turkey.

He also pointed to another casual gaming startup, Dream Games, which received $255 million that helped it join Turkey’s unicorn ventures.

This “demonstrates the richness Turkey has when it comes to gaming startups,” the number of which, moreover, continues to grow, Ünsal said.

He also linked the success to the collective track record as co-founders and many employees gained experience at Peak Games, Turkey’s first unicorn that was acquired by U.S giant Zynga for around $1.8 billion in 2020.

“The acquisition of 80% of the gaming enterprise Alictus for $100 million was the largest acquisition of the first quarter of 2022,” said Ünsal.

“So, gaming startups continued to shine in the first quarter.”

Corporate venture capital

According to the startups.watch data, corporate venture capital (CVC) funds joined one out of every three investment deals in the first three months of the year.

Among these, Esas Holding, Türk Telekom, Sabancı Holding and Eczacıbaşı have come to the fore with their recent investments.

When it comes to deal count, cloud-based software startups, software as a service (SaaS) and financial technology ventures were the ones drawing the greatest interest.

Among others, gaming, artificial intelligence (AI) and marketplace ventures were also at the forefront.

Foreign investors joined one out of every three investment deals, the data showed.

On the other hand, some 44 funds with a size of $645 million were established over the last three years.

Women make an impact

Female entrepreneurs were included in 35% of the investment deals from January through March.

Many of the billion-dollar startups in Turkey, including Trendyol, Hepsiburada and Insider, are led by female entrepreneurs.

In addition, women are prominent in impact-making initiatives engaged in industries such as education, health and artificial intelligence.

Hande Çilingir has become an inspiration for the software initiatives as a co-founder and CEO of Insider, Turkey’s first billion-dollar software venture.

Different metrics

Esas Holding, which has attracted attention in the venture ecosystem with its investment in Getir, is among the institutions that invest in startups with a global growth goal that need double-digit investment.

“Different metrics apply here. We are used to different parameters such as profitability in the areas we have entered before and to long-term investment negotiations. The situation is completely different here,” said Esas Holding CEO, Çağtay Özdoğru.

“You need to act quickly, investigate with the right investment committees. I am involved in all investment committees. We first missed the chance to invest in Getir. Then we acted more decisively,” Özdoğru said.

He noted that they would take different steps when it comes to their Esas Ventures.

“We will continue to evaluate global and local investment opportunities. We want startups that want to make bigger strides to see us as investors. In the coming period, you will see us investing more in areas such as artificial intelligence and machine learning.”

Düşyeri: Children’s edutainment platform

One of the ventures that has attracted interest in the first quarter has been Düşyeri, an edutainment platform that focuses on children.

The Istanbul-based venture managed to raise $3.7 million in a seed funding round in the first quarter at a valuation of $35 million.

Düşyeri CEO Ibrahim Coşkuner stressed the importance of funding as the venture prepares to go global.

“After we decided to quit banking and become part of the Düşyeri, we worked to fulfill our dream of becoming a child mode of phones in a stronger way,” Coşkuner said.

“We have highlighted our ability to be a platform that collects educational applications in countries with a population of more than 50 million people. The initiative, which is notable for its rapid growth, has more than 60 specially designed game and content applications, and the “Child Mode” feature, which we launched in December 2021, has reached more than 350,000 users,” he explained.

“After this investment round, we will focus on global growth.”

Kenan Çolpan, who was among the angel investors that invested in the startup in 2018, said they believe in the vision that Düşyeri pursues.

“I am very glad that they have accepted me as an angel investor as part of this dream. We believe that they will become a global success story in the coming period,” Çolpan noted.

Midas wants to change investment culture

The first neobroker of Turkey, Midas is focused on changing the investment culture in the country, seeking to be a transparent and reliable investment tool by eliminating the technology barrier.

“Shortly after we started, the pandemic broke out. In these conditions, we tried to overcome the permission processes from official institutions. In less than a year, we received over $11 million in investments from prominent domestic and foreign funds. We have grown by 150% in the last three months and have created an engineering team of 70 people,” said Egem Eraslan, Midas co-founder and CEO.

Today, Midas is accompanying the investment journey of tens of thousands of its users, Eraslan noted.

“We are the first investment of Spark Capital in Turkey, which is among the investors of Twitter and Snapchat and has investments in fintech companies such as Coinbase, Plaid, Wealthfront, Alpaca and Marqueta,” he added.

“We want to create a new investment culture and be a pioneer in it. We are completing our shortcomings in this regard.”

Erarslan said Midas is the first and only Capital Markets Board-licensed brokerage firm in Turkey that shortens the investment process of users and that they produce the infrastructure and technology that speeds up all transactions such as account opening, money transfer, stock purchase and sale from scratch.

“We offer the possibility of trading on American stock exchanges for individual investors with a trading fee as low as $1.50, without a lower limit. Midas users can also become partners by investing in world-famous companies such as Google, Apple, Starbucks, Facebook, Tesla, whose products are used by almost everyone all over the world today,” he explained.

Established with the aim of making stock investments accessible and fair, Midas provides no commission for Turkish stocks up to a certain volume and low fixed fees for U.S. stocks with no commission.

As the first and only brokerage house in Turkey, Midas also offers a guaranteed $500,000 insurance opportunity in its overseas accounts and free live data broadcasting from U.S. stock exchanges.

Speaking of the venture, Cenk Bayraktar, Revo Capital founding partner, said, “All international investment institutions already knew them.”

“This is the first time we have witnessed such a thing regarding a financial technology startup. We think they have a very clear path ahead,” Bayraktar added.

Insider: Billion-dollar software startup

The female-led SaaS startup Insider has also attracted major interest this year after it became Turkey’s latest unicorn.

According to Arda Koterin, one of the Insider founders, the most important difference of Insider is the determination to keep the talent it has inside.

“It was important to take the right steps while we were building the right team and expanding the organization. I think that it is the team that also convinces investors,” Koterin said.

“As someone who has been a salesperson, you are comfortable when you sell. But the next month everything starts all over again. In fact, when we became a billion-dollar enterprise, we realized that we had more responsibility. After all, we didn’t have an example in front of us. We learned to do business in the Far Eastern geography ourselves. We have made great efforts to do everything we promised. We have achieved targets in terms of global growth. We used the relationship network we had for this in the right way,” he explained.

Ali Karabey, the founding partner at venture capital fund 212, said “we did not invest” in Insider but “they grabbed the investment”

“In fact, we had resisted not investing. They convinced us of this. With their team, they were one of the rare startups that kept all the promises they made. Adhering to their global growth plans and using the network they have correctly has made them the first unicorn software startup. It’s exciting to see unicorn startups in the venture ecosystem today,” Karabey said.

“We were thinking ’can we make a return on investment.’ It is now exciting to see that they are a unicorn.”

Investment scale to grow

Addressing the startups.watch event, Muhammed Özhan, general manager of TT Ventures, the corporate venture capital company of Türk Telekom, spoke of the new reorganizations.

Depending on Türk Telekom’s transformation vision, Özhan said they were expanding TT Ventures’ investment portfolio and have increased their support for initiatives within the scope of the Türk Telekom’s startup acceleration program, PILOT.

“Now we will increase our investment amount by including not only Türk Telekom resources, but also domestic and foreign investors in our investment pool.”