Microsoft backs game developer Wemade in web3 push

Microsoft has backed Wemade, a popular video game developer that has made aggressive bets on blockchain in recent years, the latest sign of tech giants’ showing growing interest in web3.

South Korea’s Wemade said in a press release that it has raised $46 million from Microsoft, Shinhan Asset Management and Kiwoom Securities. In a regulatory filing, Wemade disclosed that it is raising the capital through sales of convertible bonds.

“This is a meaningful investment by reputable financial and strategic investors with proven track records,” said Henry Chang, chief executive of Wemade, in a statement. “Wemade and Wemix will continue to exert efforts to attract more capital and actively invest to build the global digital economy platform.”

Founded over two decades ago, Wemade is best known for its sleeper hit title ‘The Legend of Mir,” which at one point had over 200 million signups.

In the last few years, Wemade has been exploring ways to incorporate blockchain technology into its new titles and offerings. It recently launched its blockchain Wemix3.0 to mainnet and launched a stablecoin and a DeFi platform. The company says it is aiming to “transform everyday games with blockchain technology and establish its Wemix coin as a key currency in the blockchain gaming space.”

“A new economy platform NILE that supports NFT and DAO will be introduced soon as well. (EOD),” Wemade said in the press release.

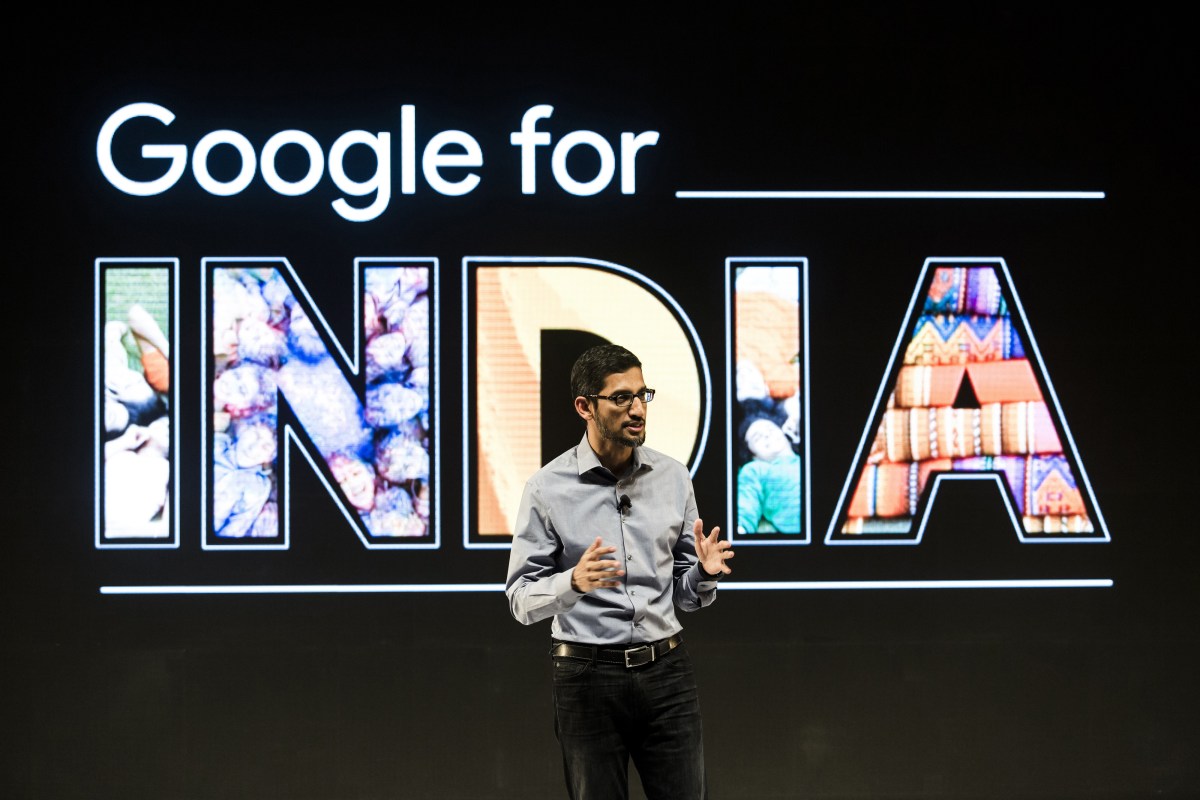

Scores of tech giants including Microsoft and Google and storied banks have made a series of investments in the web3 space in recent years. Microsoft is also an investor in ConsenSys, the firm behind MetaMask wallet and enterprise solutions such as Infura, as well as decentralized data warehouse Space and Time and NFT studio Palm, according to Web3 Signals. Google Ventures has backed fraud detection service Sardine, trading app Blockchain.com and NFT startup YugaLabs, according to the tracker.

Microsoft, which operates the Xbox gaming ecosystem, has invested $14.8 million in Wemade through purchase of convertible bonds, Shinhan $21.2 million and Kiwoom $10.5 million, regulatory filings showed.

Kate Park contributed to this report.