Mainstack’s no-code online business service eliminates cross-border payment complexity | TechCrunch

Ayobami Oyaleke and Olamide Akinola grew up in Nigeria dreaming of launching a tech startup. Today they are living that dream with Mainstack, a no-code website-building tool for small business owners that includes a twist: a tool that makes it easy to accept cross-border payments.

Mainstack is also part of the 2023 TechCrunch Disrupt Battlefield 20, competing this week in San Francisco for an equity-free $100,000 grand prize,

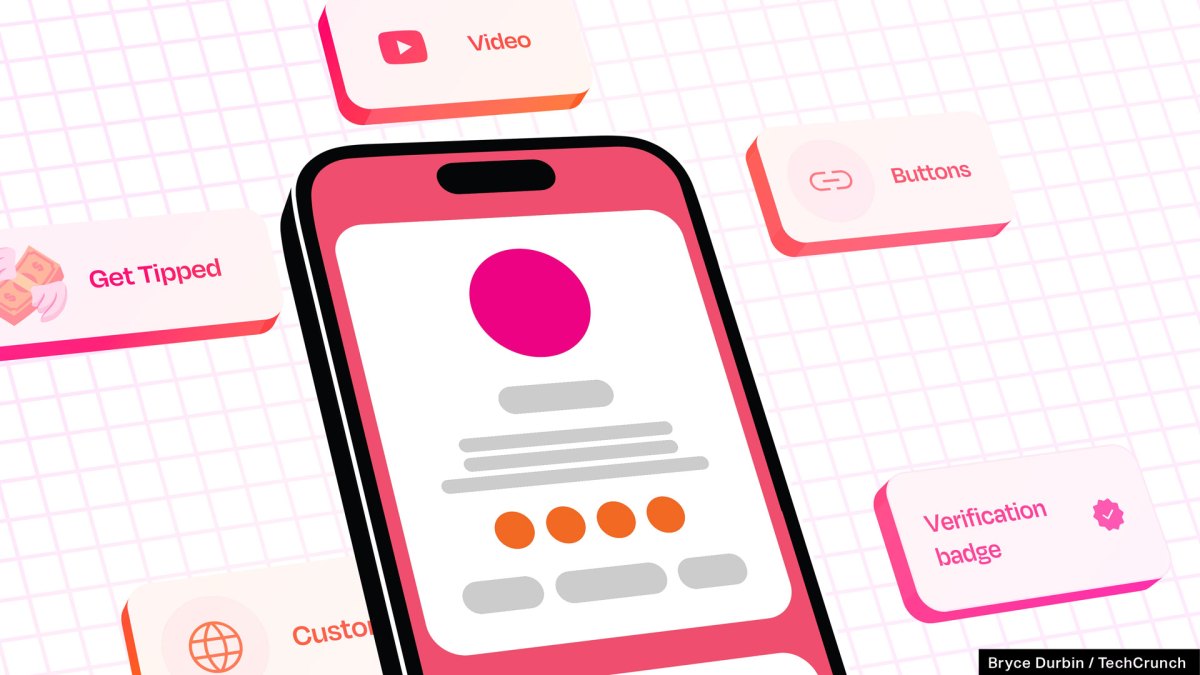

“We build no-code solutions with payments for creators and entrepreneurs to be able to showcase their work and receive payments from their customers globally,” Oyaleke told TechCrunch. The product is aimed at folks selling professional services and includes the ability to sell content like e-books and videos or set up classes, workshops, webinars and events, while being able to get paid in local currency, regardless of where their clients live.

It comes with a slew of free tooling for setting up a storefront, a media kit and portfolio to get started, as well as access to a set of analytics tools to better understand how the business is performing.The company has people from 125 countries using their product, according to the website.

And with that kind of international presence, the payments part is key. Oyaleke had personally struggled to convert payments into local currency when he was living in Nigeria, while working for U.S. companies. It was something that stuck with him, and something he wanted to resolve eventually with a startup of his own.

The two founders met in Nigeria in 2017 through a mutual friend and bonded over a shared love of technology and startups. Akinola moved to the U.S. that year, eventually working as a technical product lead at Google. Oyaleke followed a year later. His last job was with Meta as a business analyst. The two were roommates for three years, constantly exchanging startup ideas.

Pay me my money down

Oyaleke says when he got to the States, he was working in an accelerator, sponsored by Meta and the U.S. government, alongside other entrepreneurs, who were still facing this same problem of converting payments from international customers or clients into local currency. He said it sometimes took him as long as three to four weeks to get paid, while enduring hefty transaction fees when he was living in Nigeria.

“They were still facing the same difficulties of getting paid after doing really excellent work for their customers globally in different countries. So I saw the need to come up with something very simple to actually solve that problem,” he said.

The two founders went to work, launching a pre-beta product in January 2022 with résumé and storefront tools, the latter of which included the payment processing part, just to see if people were interested. And sure enough, driven by little publicity other than a couple of third-party Tweets, the product attracted 3,000 users processing $100,000 in transaction volume in just one month.

That’s when knew they were on to something and went to work building the first full version, which launched a year ago. At that point they quit their day jobs to concentrate on the startup. While some family and friends questioned the wisdom of leaving well-paying jobs at big companies, most supported the two founders following their dreams.

While both can code, Akinola took the lead and became CTO, and Oyaleke CEO.

It was also about this time that they went looking for funding. It’s no secret that fundraising can be a hard slog for Black entrepreneurs in general, and for Black immigrant founders, the bar might have been even higher. They said they heard no a lot, even with numbers showing substantial growth month over month.

“To be very honest, it was a little bit difficult even though we had traction,” Oyaleke said. They would send their numbers every month showing their increasing growth, but they were for the most part ignored, except by Black VCs. “I would say if you take a look at our cap table today, a larger chunk of the people that made the biggest [investment] were Black-led VCs,” he said.

They raised a total of $500,000 at the beginning of this year led by Techstars, Midlothian Angels Network and a couple other notable angels, according to the company. While the main set of tools is free forever, they make money in a couple of ways. First of all they take a small percentage of the transactions that take place inside their global payment tool. The other way is through a subscription service that gives users access to advanced features like QuickBooks integration.

Both founders say the Battlefield experience has been invaluable to them in helping them refine their message for customers and investors. While they hope to win, of course, they are also looking to meet with new customers, partners and investors to keep growing the company.

“It’s been very engaging, they’re very hands-on. That’s one thing I can really say for them. They are always ready to provide support and they are always there to help because they really know the journey we are on,” he said.