Customer and employee experience: The new normal

If digital transformation was a strategic business priority in the pre-2020 era, the pandemic propelled it to an existential imperative. Consumers witnessed the results of this enforced experiment in myriad ways. Their favorite clothing brand launched virtual try-on services. Their doctor became accessible via telehealth appointments. Even their local government—not an entity typically associated with expediency—released an app that gave citizens connected access to services in a fraction of the usual time.

Now, we’re teetering on the precipice of a post-pandemic business landscape—the next phase of what’s been dubbed “the new normal.” Employees and customers consider digital interactions like the ones outlined above a given, and many of the shifts set off by the pandemic seem poised to stick around for years or even decades to come.

In fact, Pew Research found that a full 86% of respondents to a survey about post-pandemic life expect the pandemic to have lasting effects on everyday experiences. In the context of retail and ecommerce, more people expect to shop online post-covid than ever before—even for unconventional products and services, according to the World Economic Forum (WEF). On the workplace front, employees are seeing both advantages and challenges to the new world of hybrid and remote work. Microsoft’s Future of Work 2022 Report outlined benefits including an uptick in collaboration platforms and a baseline improvement of accessible digital workspaces, as well as hurdles like “video call fatigue” and the rise of employee burnout.

While the covid crisis catalyzed a more virtual, mobile, and distributed business ecosystem, reliance upon digital experiences is now an unstoppable cultural shift. To remain relevant, businesses must continue iterating upon pandemic-sparked digital efforts that serve both customers and employees.

In a survey conducted by MIT Technology Review Insights, respondents cited priorities like implementing self-serve and personalized experiences—all with digital trust at the fore. Sixty-two percent of respondents noted the pandemic prompted their organization to improve internal messaging and communication systems, 53% noted they had bolstered self-service capabilities, and another 53% said they’d improved integration and support over digital channels to facilitate smoother operations (see Figure 1).

Digital experience across sectors

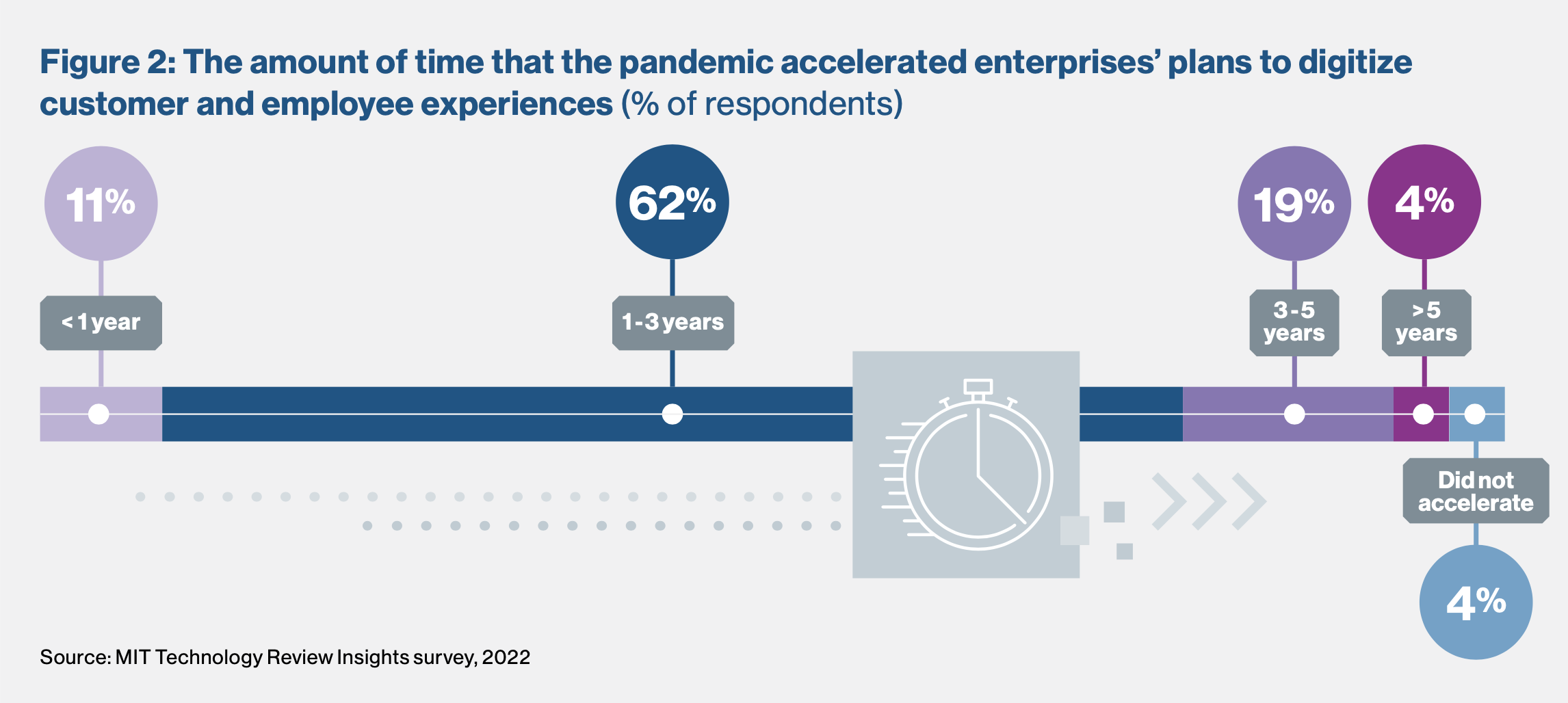

Exclusively crediting covid-19 with the current digital evolution is overly simplistic. Even before the pandemic, businesses across nearly every industry were eager to invest in emerging technologies. That said, there’s little doubt that the pandemic was an accelerant. In 2020, online retail sales increased by more than 30%.4 They grew another 14% in 2021. According to our survey data, the majority of respondents (62%) noted that the pandemic hastened the digital transformation of customer and employee experiences by one to three years (see Figure 2).

Lax Gopisetty, the global vice president at Infosys, notes that many businesses have now “recalibrated” to adopt technology as a core competency rather than a supporting one. Today, digital experiences have transitioned from piecemeal tools for process management or data collection into a disintermediated, service-oriented component of nearly all business operations.

Decision-makers and executives have come to realize that siloed strategies are insufficient, too. A proportionate employee experience (EX) must be implemented to offer an engaging customer experience (CX). Gartner estimates that by 2024, retailers providing this “total experience” spanning both considerations will outperform competitors’ satisfaction metrics for EX and CX by 25%.

What’s more, an integrated “total experience” strategy is likely to encompass both digital and in-person features. A full 44% of our survey respondents plan to prioritize the implementation of “hybrid” experiences that blend both digital and real-world elements into their customer experience strategy over the next year, and more than 30% plan to implement similar hybrid systems into their employee experience strategy.

Aside from the pandemic, one reason for this trend is today’s hyper-competitive landscape. “There are so many new, innovative companies that have disrupted existing operating models,” says Gopisetty. “Traditional organizations recognize this as a significant threat, not only because of the talent shortage or supply chain disruptions, but because of not knowing their customers and having this new set of competitors in play.”

Certainly, digitally native companies have an advantage over legacy organizations that have had to make a shift from analog to digital systems and processes. But while this latter cohort has had to play catch-up, their preparedness predates the pandemic. According to the MIT Tech Review Insights survey, around one-third of respondents said their organizations were “very well prepared” to stay relevant and competitive with digital experiences in the wake of the covid-19 crisis. About half reported being “moderately prepared”.

There are plenty of examples of long-standing business models making the pivot to tech-centricity. Traditional car manufacturers, for instance, used to operate via district dealership models. Now, taking a page out of the book of innovators like Tesla and Rivian, many auto companies are shifting to a model of “automobile services” or “transportation services” versus dealerships. Incumbents like Volvo are even evaluating how to sell EVs directly to customers.

Traditional financial services brands, too, are rapidly embracing a tech-centric model. While in the past, their focus was largely on brand positioning, product value, and customer services, today, a good chunk of their value lies in technological competencies like cloud capabilities and implementing artificial intelligence (AI) and integrated digital experiences—the rise of robo-advisors complementing human expertise comes to mind as an example.

Download the full report.

This content was produced by Insights, the custom content arm of MIT Technology Review. It was not written by MIT Technology Review’s editorial staff.