YL Ventures details the challenges facing Israeli cybersecurity startups | TechCrunch

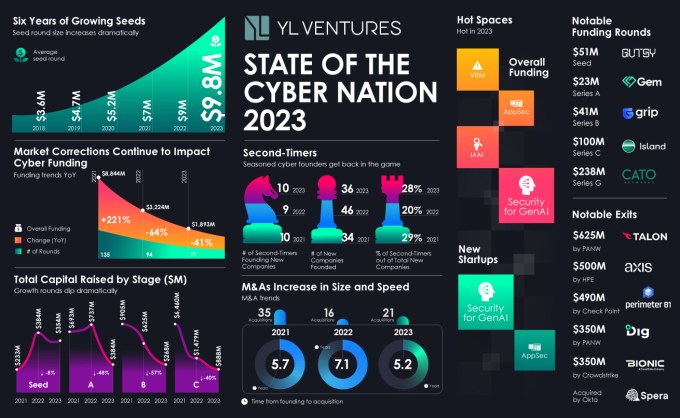

The Israeli cybersecurity industry, much like the global one, has been undergoing an evolution that seemed to peak in 2021 with soaring funding rounds, overwhelming valuations, and multiple newly minted unicorns, only to cool down dramatically amidst the market slowdown of 2022 with steep declines and frozen growth rounds. The breakneck speed of these fluctuations led to ramifications that reverberated across the industry throughout 2023, as Israeli cybersecurity startups had to adapt and find their footing in this new post-bonanza funding reality.

Each year, YL Ventures monitors, analyzes, and publishes data on funding and acquisitions in the Israeli cybersecurity market, with insights from industry luminaries to illuminate the trends and shifts in this fiercely competitive and relentlessly trailblazing industry. In 2023, despite declines in fundraising overall, we can identify trends indicating a positive trajectory for the industry, including an increase in exits. These trends are evident in continued investment in promising cybersecurity startups and in the determination of skilled, experienced entrepreneurs to find and address the most acute and urgent security problems ailing the business world today.

Image Credits: YL Ventures

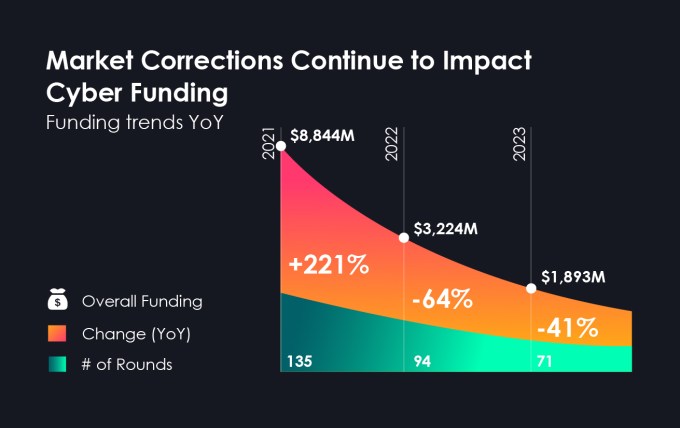

Beyond the general macro aspects, specifically in the cyber domain, the prevailing explanation for this downward trajectory is a continuation of market corrections following the sharp increases of 2021. Toward the end of 2023, Israel was faced with national, economic, and geopolitical challenges. The ongoing war between Israel and Hamas has impacted the Israeli tech sector much like the rest of Israeli society, but its resilience and determination form the foundation for increased growth, stability, and longevity despite unprecedented challenges. There were several impressive funding rounds and acquisitions of Israeli cybersecurity startups in the final quarter of 2023, despite the circumstances, and the effects of these events will most likely be evident only in the first half of 2024.

Overall Funding in 2023

Image Credits: YL Ventures

In 2023, the overall decline in tech investments continued, with total funding of Israeli cybersecurity startups reaching only $1.89B across 71 funding rounds, down 41% from 2022’s total – $3.22B across 94 funding rounds. “In 2021, the irrational exuberance in the financial markets led to inflated valuations across the startup landscape, including cyber,” remarks Erica Brescia, Managing Director at Redpoint Ventures. “What we’re witnessing now is not a slowdown, but rather a return to pre-pandemic sanity – a market correction that paves the way for healthier startups.”

Early Stage Funding

Unlike overall funding trends, there was a significant increase in the average seed round for the sixth consecutive year, from $9M in 2022 to a record $9.8M in 2023. This can be attributed to the constant and growing need for groundbreaking security solutions to resolve unrelenting security issues and sustained investor appetite for supporting innovative founding teams able to do so. While the average seed amount grew, the number of seed rounds in 2023 was only 36, decreased from 46 in 2022.