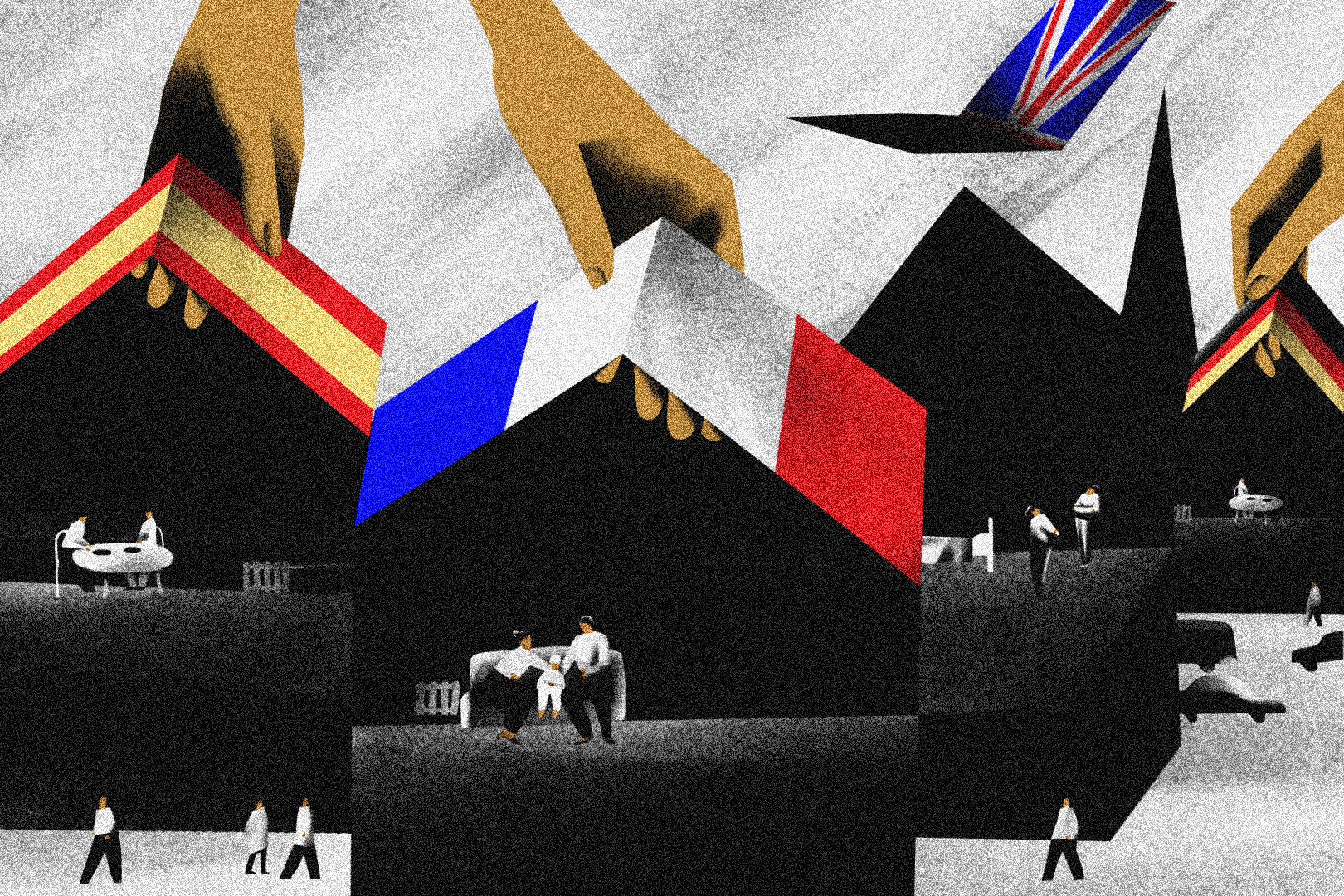

Which European nations are handling the energy crisis best?

Tax breaks. Reduced electricity use. And a desperate hunt for alternative sources of gas. Europe is grappling with one of its biggest energy crises in memory, just as the cold, dark days of winter set in.

Russia’s invasion of Ukraine in February this year exacerbated supply issues and led to the cost of imported natural gas spiralling upward. Governments across Europe have tried a diverse set of measures to shield citizens from the worst effects of surging prices while keeping their economies afloat. But worker strikes and burgeoning street demonstrations in multiple cities show that the pain is real and deep for millions of people.

Al Jazeera spoke to economic experts to see which European countries are dealing with the crisis better than others, what’s working and what isn’t.

The short answer: France and Spain have curbed inflation the best, while Italy, Germany and Greece are leading in long-term preparations to secure their energy needs. And the United Kingdom is struggling.

An uneven risk

Russia accounted for nearly half of Europe’s total natural gas imports in 2021, but some countries were always going to be more vulnerable than others.

Poland, Finland and Slovakia were almost fully dependent on Russia for their natural gas because of their geographical proximity to its supply pipelines. Germany, Europe’s largest economy, has been reliant on Russia, importing half of its natural gas from the country in 2021. The vast German chemical industry, which employs more than 300,000 people, uses natural gas as a raw material.

Then there are countries that have traditionally had a higher share of natural gas in their total energy mix: Italy (40 percent), the Netherlands (37 percent), Hungary (33 percent) and Croatia (30 percent). While these countries depended on Russia to different degrees, they all witnessed sharp inflation as gas prices soared to record levels.

Still, experts said some countries are showing the way in looking for alternatives to Russian gas.

Leaning on LNG

Europe as a whole is moving towards liquefied natural gas (LNG) to cut its dependence on Russian gas, which is mostly delivered through pipelines. Between January and September this year, the European Union imported more LNG than it had ever bought in an entire year.

Within Europe, Italy “has been proactive in finding LNG supplies”, Maartje Wijffelaars, senior economist (Eurozone) at Netherlands-based Rabo Research, told Al Jazeera.

Wiffelaars said Italy started looking for alternate gas supplies from Azerbaijan, Algeria and Egypt soon after the war broke out. That Algeria – a major gas exporter – sits just across the Mediterranean Sea helped.

Some countries, including Spain, France and Italy, have the advantage of a head start in the form of existing fixed LNG terminals, Wiffelaars said, compared with other European countries like Germany that have traditionally relied more on pipeline gas. Along with the UK, these countries have the highest LNG import capacity in the region.

Many others are turning to floating terminals, which take less time to set up than permanent ones on land.

Taking the lead in this initiative is Germany, which recently finished building the first of five planned floating LNG terminals. Once they are all up, Germany will have one of Europe’s highest import capacities. Greece is also planning five floating LNG terminals, which could make it a hub for southeastern European countries.

But LNG from countries such as Qatar, Australia and the United States will take at least a couple of years to increase as new projects come online.

“Until then there will continue to be an upward pressure on energy prices,” Ben Cahill, a senior fellow in the Energy Security and Climate Change Program at the Center for Strategic and International Studies, told Al Jazeera.

Already, in recent months, the Eurozone has witnessed the sharpest rise in inflation since its inception – approximately 70 percent of that inflation in September was due to energy prices.

But some countries have done better than others in shielding their citizens.

Taming prices

France has frozen household gas prices at October 2021 levels and capped the electricity price increase in 2022 at 4 percent over last year’s. It recently announced limiting the power and gas price increase to 15 percent next year.

Without these measures, household bills would have more than doubled. The cost will be borne by the French public operator.

The country has traditionally relied less on Russian gas (7.6 percent of total gas imports) than many other European nations, but depends heavily on nuclear power. Many of its nuclear power plants are undergoing maintenance, meaning France has an energy shortage. But its price caps on gas and electricity have allowed it to keep its inflation the lowest across the EU over the past 12 months.

After France, Spain has stood out in terms of buffering citizens from inflation through a host of tax reduction measures and a cap on the gas tariff, according to a November 18, 2022, Rabo Research report.

Is there a lesson there for other European countries? After all, since September 2021 – when natural gas supply bottlenecks began in the months leading up to the war – many of them have been keeping aside funds to deal with the crisis. As oil and gas prices have soared because of the war, these countries have added to this kitty.

Germany accounts for 264 billion euros ($281bn) – or nearly half – of the total 600 billion euros ($638bn) earmarked for the energy crisis by EU countries, according to Brussels-based think-tank Bruegel. Germany’s relief measures account for 7.4 percent of the country’s gross domestic product (GDP). It is followed by Lithuania (6.6 percent), Greece (5.7 percent), the Netherlands (5.3 percent), and Croatia (4.2 percent).

But while France and Spain are capping prices and giving discounts on fuel prices to cushion citizens from high costs, others – including Germany – have focused most on providing direct financial support to vulnerable populations, while also embracing measures such as duty cuts on motor oils and windfall taxes on energy companies. In Austria, for example, households have received a one-time discount of 150 euros ($158) on their energy bills, with the most vulnerable receiving double that.

Germany’s emphasis on boosting household and business incomes has ironically contributed to an increase in demand and higher inflation. By contrast, France and Spain have taken direct measures to curb inflation by controlling electricity prices, Wiffelaars said. However, from next year, Germany will begin subsidising power bills for consumers, which should bring inflation down.

Yet while France and Spain have kept prices under control and Germany leads the way in its funding support, the UK is doing neither. Its inflation rate of 11.1 percent in October was the highest in 40 years. And, unlike Germany, it has set aside resources equivalent to only 97 billion euros ($103bn) to deal with the energy crunch – just 3.5 percent of its GDP. Britain has rolled back earlier plans to freeze energy prices for two years, instead limiting that period to six months until March 2023.

As different countries adopt different measures, Europe as a region faces difficult questions in the weeks, months and years ahead, said experts. The biggest among them: Should each nation think of itself first?

Challenges ahead

Germany recently announced a new 200 billion euro ($210bn) package to deal with rising gas prices, upsetting other countries that have been calling for a coordinated EU response.

“There is an ongoing debate as to whether the EU should collectively take measures or should it be at the country level,” Philipp Heimberger, an economist at the Vienna Institute for International Economic Studies, told Al Jazeera. “As we move ahead in the winter months, this debate will intensify.”

He believes the crisis may propel changes in the industrial policies of major economies.

“In countries like Germany, large parts of the industrial sector have benefitted from low energy prices, over a rather long period of time,” he said. “We have to wait and see to what extent this leads to deindustrialisation in Germany since the competitiveness of energy-intensive sectors will go down.”

Overall, Europe’s mounting appetite for LNG makes it the main driver of global gas trade in the coming years, accounting for more than 60 percent of the net global growth in imports during 2021-2025, according to the International Energy Agency.

However, Europe’s LNG regasification terminals – where the fuel is converted back into natural gas – “are not networked well to the entire continent,” warned Cahill. “It’s a very fragmented system … putting some countries at a disadvantage.” The worst-connected region is southeastern Europe, which has traditionally also been among the most dependent on Russian energy.

Wijffelaars said a shift to renewable energy would help. But there, too, Europe needs to be careful. Europe imports 98 percent of the rare earth element supplies it needs to make electric vehicles, batteries and permanent magnets for electricity generators from China.

“We know China possesses a lot of rare earths and raw materials that we might need for our energy transition,” Wijffelaars said. “But, to the best of our abilities, we will have to diversify the portfolio as much as possible so that we are not making ourselves dependent on one country.”

It’s a mistake Europe can’t afford to repeat.

Each article in this series answers a Big Question on the minds of readers globally, decoding different challenges that affect lives around the world.