Unveiling the winning formula: How B2C fintechs conquer customer acquisition | TechCrunch

In the fast-paced world of B2C (business-to-consumer) startups, mastering marketing spend is the key to achieving sustainable growth and securing a leading position in the market. While there’s often a formula to follow, it’s not uncommon to see CEOs and startup founders grappling with these crucial decisions for the first time.

To shed light on this critical matter, we surveyed select portfolio companies to understand their current marketing expenditure patterns. Additionally, we meticulously analyzed the journey of our longest-standing companies, observing their growth from the initial seed stage to IPO readiness.

In this article, I’ll dive deep into the best practices and successful strategies that have proven to elevate B2C fintech companies to the forefront of their game. Expect evidence-based recommendations that will pave the way for your company’s success in the highly competitive business-to-consumer landscape.

#1: Prioritize focus on one to two dominant channels

Image Credits: Ian Sherman

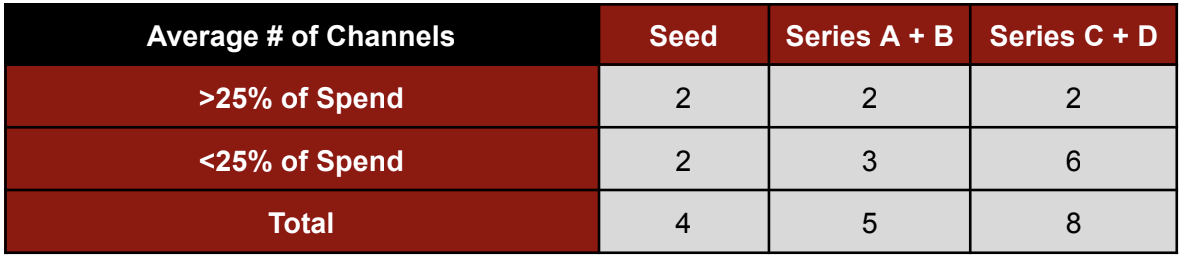

Amid the barrage of marketing channels available, the mantra for B2C fintechs is “less is more,” and our evidence-based research supports this approach. Our in-depth analysis of companies from seed to Series D stages revealed that allocating marketing spend to just one to two dominant channels can be a game-changer.

Amid the barrage of marketing channels available, the mantra for B2C fintechs is ‘less is more,’ and our evidence-based research supports this approach.

This was agnostic of company size as well. While our later-stage portfolio companies tended to diversify their marketing efforts and invested in a larger number of channels as opposed to their earlier stage counterparts, our companies consistently maintained a strategic focus on just two core marketing channels that made up greater than 25% of their annual spend.

Our findings clearly demonstrate that despite expanding their marketing channels as they grow, successful B2C fintechs consistently prioritize their investments in the most impactful and effective channels.

This approach allows them to build upon their proven strategies while exploring new avenues for growth. By honing in on these core channels, B2C fintechs can ensure they’re acquiring customers efficiently and with purpose.

#2 While there’s no right way to grow, consider Google Search, Partnerships and Meta as core channels

Image Credits: Ian Sherman

While there’s no one-size-fits-all approach to growth, our research has uncovered key insights that strongly suggest considering Google Search, Partnerships, and Meta platforms as core channels in your marketing strategy: