Turkey's Market Shows Positivity With Rising BIST 100 Index

What’s going on here?

Turkey’s BIST 100 index climbed by 1.26%, closing at 9,842.15 points, signaling market optimism even as the lira slightly weakened against the US dollar.

What does this mean?

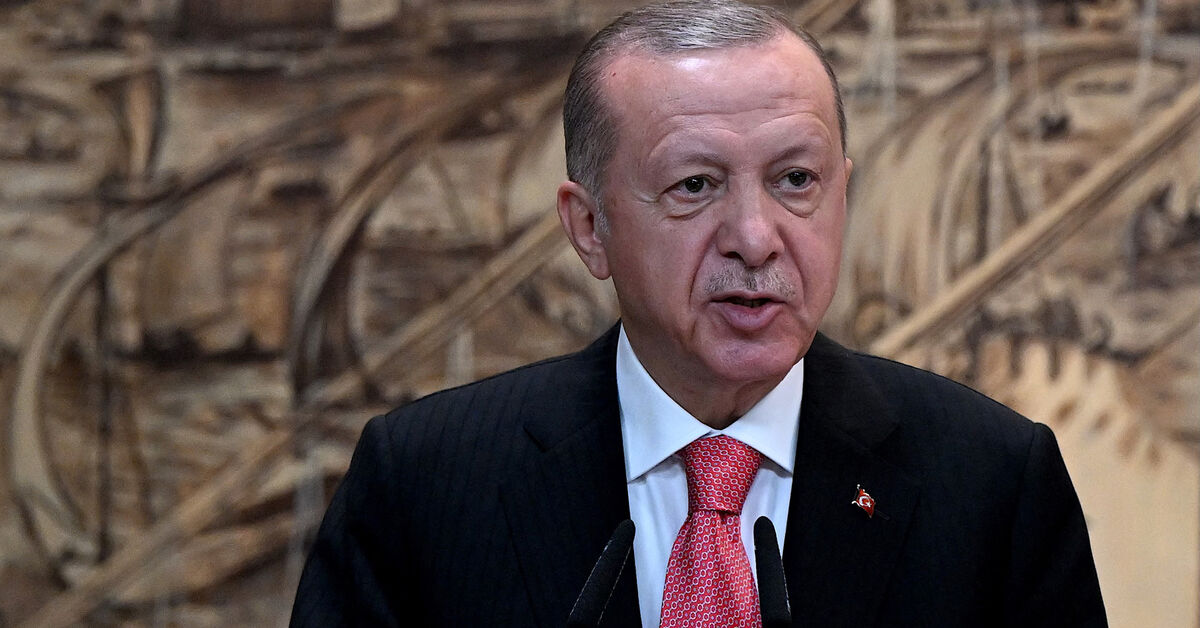

The positive movement in the BIST 100 reflects growing confidence in Turkey’s market ahead of significant economic announcements. Even though the lira traded a bit weaker at 35.9950 to the US dollar, investor sentiment remains upbeat. Reinforcing this optimism, Turkey’s Central Bank Governor delivered the quarterly inflation report, marking an important commentary since the country’s big rate cut from 50% last December. Meanwhile, Asian markets are ticking up with anticipation of US payroll data, and Japan’s yen has risen with expectations of further rate hikes. Domestically, all eyes are on President Erdogan’s upcoming speech, which could outline future economic strategies as the Turkish Treasury gets set to reveal its cash balance for January, a key indicator of fiscal health.

Why should I care?

For markets: Anticipation fuels market momentum.

The rally in Turkey’s BIST 100 index reflects a positive market sentiment that might steer investors’ strategies. With the Turkish lira maintaining slight stability, this offers potential support for ongoing market activities. Investors are eagerly anticipating domestic economic discussions for any policy changes that might influence market conditions and investments.

The bigger picture: Economic signals and political stages.

Turkey is at a crucial juncture, engaging stakeholders on multiple economic fronts. Infrastructure developments, such as metro line trials, and industrial progress highlighted at Istanbul’s technology summit, suggest long-term growth potential. As President Erdogan and the opposition emphasize domestic recovery and fiscal strength, global observers assess how these reforms may affect Turkey’s international stance amid geopolitical shifts.