Turkey’s Gold Imports Slump Again on Government Restrictions

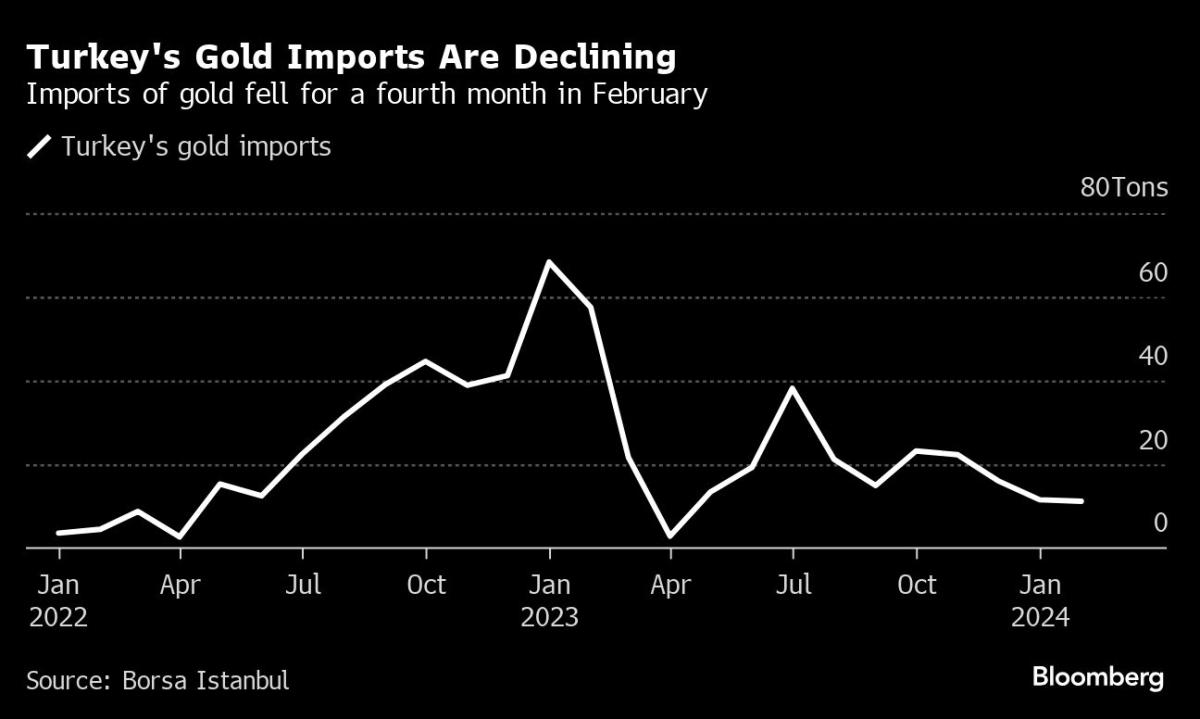

(Bloomberg) — Turkey’s gold imports declined for the fourth straight month as government restrictions meant to shore up external finances squeeze supply, even in the face of soaring domestic demand.

Most Read from Bloomberg

Shipments fell in February to 11.2 tons, data from Borsa Istanbul shows, compared with the monthly average of 26.6 tons in 2023. It’s the longest streak of declines since 2021.

A state-imposed quota introduced in August is behind the drop, according to two gold traders who spoke on condition of anonymity because they weren’t authorized to speak with the media. It’s exacerbating already strong demand inside the country amid high inflation and uncertainty over local elections scheduled for March 31, they said.

That’s reflected in the disparity between the local and international markets, with the lira price for an ounce of gold climbing 15% this year, almost triple the dollar equivalent, according to data compiled by Bloomberg.

Smallest Turkish Gold Imports Since 2022 Improve Current Account

“Jewelers can only access some of the monthly gold imports, and the actual demand is higher than that,” said Burak Yakin, chairman of the Turkish Jewelery Exporters Association.

Bullion hit a record in London last week following a rally spurred by central bank buying and expectations that the US Federal Reserve will cut interest rates.

Turks use gold to protect their savings against price increases and to gift at ceremonial events, including weddings. It’s also used to pay rent by some merchants at Istanbul’s Grand Bazaar, one of the world’s oldest covered markets.

Turkish demand for bars and coins soared 88% in 2023, while demand for jewelery jumped 14%, according to World Gold Council data.

An aggressive cycle of monetary policy tightening since June has pushed bank deposit rates higher, but they’re still not attractive enough to significantly dent gold’s appeal for households.

–With assistance from Mark Burton and Asli Kandemir.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.