Turkey’s dream of a hub. Ankara’s wartime gas policy

Natural gas plays a key role in Turkey’s economy and energy sector, with the country’s gas consumption growing in recent years. At the same time, Turkey is fully dependent on imports of this resource, including large quantities from Russia. However, for years it has been implementing a policy of diversification, which has brought tangible results. Along this, it has been expanding its import infrastructure to diversify its gas supply sources and routes, for example by opening more LNG terminals; or by trying to start production of its own gas while curbing domestic consumption.

Against the backdrop of the war in Ukraine and the crisis on the gas market, Turkey’s situation is markedly different from that of the European Union’s member states. The gas crisis in Europe has led to record-high and volatile prices as well as reduced gas availability, which resulted in shortage risks during last year’s winter. For its part, Turkey has been able to secure stable supplies thanks to its extensive import infrastructure, existing contracts and good relations with Russia; yet its biggest challenge remains rising prices. As the Turkish government pursues its traditional two-pronged policy of cooperation with both Russia and the West, it sees the war as an opportunity to strengthen its position and advance its energy interests with both sides. Russia’s weaker position has given Turkey the opportunity to negotiate more favourable terms for gas imports. Several other factors have also created unique circumstances enabling Turkey to realise its ambitions – first formulated two decades ago – to become a major regional and European gas hub. These include Turkey’s growing importance as the Kremlin’s key gas partner at present, its ever-closer cooperation with other regional gas producers (including Azerbaijan) and the EU’s massive demand for non-Russian gas. However, Turkey’s closer ties with Russia in this field carry the risk of making it structurally dependent on Moscow in the long term.

The role of gas in Turkey’s energy sector and economy

Natural gas was the most important source of primary energy in Turkey’s energy mix in 2021, accounting for 30.2% of domestic consumption.[1] Gas consumption has been increasing in recent years,[2] but fell by 7.4% y/y in 2022[3] as a result of a milder winter and the country’s economic problems. In 2021, gas also accounted for the largest share (34.0%) of electricity generation in Turkey. In 2022, due to the crisis on the gas market, the share of this fuel fell to 22.7%, while that of coal increased.[4] The government has been working over the years to diversify the country’s energy generation, a process that is set to accelerate with the planned commissioning of the Russian-built Akkuyu nuclear power plant in 2023. At present, however, gas still plays a key role in Turkey’s energy sector, which is related to factors such as the possibility of flexibly increasing or decreasing production from its gas-fired power plants depending on the level of renewable energy generation and prices. The significant increase in gas use in 2021 (by around 24% y/y) was partly caused by drought, which reduced the level of hydropower generation.[5] Meanwhile in 2022, gas consumption fell as a result of the record prices on global hubs.

Source: The Turkish Energy Market Regulatory Authority (EPDK), epdk.gov.tr.

Source: The Turkish Energy Market Regulatory Authority (EPDK), epdk.gov.tr.

Households, electricity generation and heating sectors, along with industry have consumed the most gas in recent years (see Chart 2). This shows that gas is not only important for Turkey’s energy generation and its economy overall, but it also plays a vital role in providing heat & energy to Turkish society: around 80% of households use this type of heating.[6]

The security of gas supplies: infrastructure, contracts and storage facilities

Turkey is 99% dependent on gas imports. Although it has sought to diversify its gas sources and reduce its dependence on Russia, this country remains Turkey’s main supplier. Russia’s share of Turkish gas imports has been falling in recent years, but rose again to 44.9% in 2021 as a result of the situation on the global markets and a spike in domestic demand. In 2022, Russia’s share fell slightly, though it remained high at around 40%. Gas is also supplied to Turkey from countries such as Iran (17.2%) and Azerbaijan (15.9%). In the last decade, thanks to both global developments and the expansion of the Turkey’s infrastructure, the role of LNG has also increased significantly: its supplies have doubled, and in 2021 they accounted for up to 24% of the country’s total gas imports.[7] Around half of Turkey’s LNG came that year from Algeria and Nigeria under long-term contracts, while the rest was purchased on the spot market, especially from the US and Egypt. The volume of LNG supplies and their importance in total Turkish imports depend largely on the global market situation, including gas prices and availability. Despite the lack of complete data, it can be assumed that the share of LNG did not increase in 2022, especially as pipeline supplies from Russia remained strong.

Source: The Turkish Energy Market Regulatory Authority (EPDK), epdk.gov.tr.

Turkey was able to secure stable gas supplies in 2022 thanks to its well-developed import infrastructure (pipelines and LNG terminals), storage facilities, existing contracts, and finally, its good relations with Russia, which ensured that imports remained predictable. This is the result of Turkey’s long-standing strategy and its investments in expanding its infrastructure, which have allowed the country to diversify its gas sources. The country’s current import capacity (around 129.5 bcm per year) is more than double its annual demand. However, rising costs of gas imports continue to pose a challenge for Turkey.

In recent years, Turkey has been broadening its range of gas sources primarily by expanding its capacity to import LNG. It currently has five terminals (two land-based and three floating FSRUs) with a combined import capacity of 53 bcm per year, which accounts for about 40% of the country’s total import capacity. A fifth terminal (and also the third FSRU), Saros, has been completed in the first quarter of 2023. This allows Turkey to increase its total import capacity as to cover almost 100% of the country’s domestic gas demand.

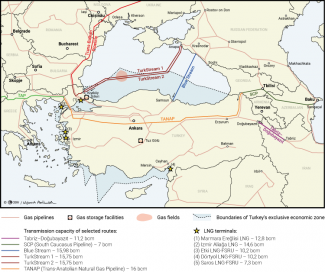

Two new pipelines have also helped to boost Turkey’s infrastructure import capacity and diversify its import routes. The TANAP gas pipeline, launched in 2018, has increased Turkey’s capacity to source gas from Azerbaijan, while TurkStream, inaugurated in 2020, has provided another connection to Russia in addition to the Trans-Balkan gas pipeline and Blue Stream. Both pipelines have also had a positive impact on Turkey’s transit importance by making it possible to increase the flows of gas from Azerbaijan and Russia to the countries of south-eastern Europe and Italy. The Trans-Balkan route (see map), which ceased to be used for Russian gas exports since 2020, offers additional opportunities to import gas from the European market or for transit/re-export of gas from other sources to Europe. All these elements ensure that Turkey’s import capacity significantly exceeds domestic consumption.

Map. Gas infrastructure in Turkey

Sources: Republic of Türkiye, Ministry of Energy and Natural Resources, enerji.gov.tr; Energy Community, energy-community.org.; BOTAŞ, botas.gov.tr.

An important factor ensuring the stability and security of Turkey’s gas supplies is the existence of medium- and long-term contracts, totalling 55.4 bcm per year, that meet around 90% of the country’s domestic demand.[8] The most important of these are BOTAŞ’s multi-year agreements with Russia’s Gazprom (16 bcm per year) and Iran’s state-owned company NIGC (9.6 bcm per year). Smaller volumes are imported under an agreement with Azerbaijan (6 bcm per year). LNG purchases on the spot market totalled only 6.9 bcm (11.8% of imports) in 2021.[9] Turkish contract data suggests that almost three quarters of the gas imported in 2022 was purchased at prices 100% linked to a basket of oil prices (crude and/or petroleum product prices), while the rest was linked to hub prices.[10]

Turkey has been striving for years to reduce its dependence on long-term gas supply contracts so as to be able to adjust the level and sources of its gas imports to changing demand and market conditions. As a result, we can see a gradual increase in the share of flexible medium and short-term contracts and purchases on the spot market. The past year was marked by increasing uncertainty, heightened global competition, spikes and volatility of gas prices on hubs in Europe, as well as the threat of shortages during the winter season. In this uncertain environment, Turkey’s import mix appears to guarantee predictable and stable supplies at relatively favourable prices, which are certainly not as volatile and unpredictable as those in most EU countries.

The ongoing expansion of domestic storage capacity will also enhance Turkey’s gas security. The enlarged Silivri facility, whose capacity (currently 4.6 bcm) makes it the largest of its kind in Europe, was officially opened in mid-December 2022. As a result, by the end of 2022 Turkish storage facilities were able to hold as much as 5.8 bcm of gas, and this figure is set to rise to 10 bcm once the upgrade of another unit (Tuz Gölü) is completed in 2023.[11] In addition, a certain amount of LNG can also be stored at the terminals. According to official statements, the storage facilities were 100% full[12] before the start of the 2022/3 heating season, but these figures were based on Silivri’s pre-expansion capacity. With average gas consumption of up to 6.5 bcm per month in winter (2021 figures)[13], this means that gas from storage facilities could only meet demand for a period of around three weeks last winter.

In the longer term, the country’s gas security will improve thanks to higher domestic gas production and falling demand from the electricity sector. The discovery of gas fields in Turkey’s economic zones in the Black Sea (their total volume is estimated at 710 bcm)[14] and ongoing exploration work are expected to enable initial production of up to 4 bcm per year as early as in 2023.[15] The level of extraction is set to rise in subsequent years, and ultimately to reach 14–15 bcm per year by 2026.[16] This would reduce Turkey’s dependence on gas imports. In parallel, natural gas demand from the electricity sector is likely to stabilize or fall following the launch of the country’s first nuclear power plant at Akkuyu next year. This plant is expected to cover 2.5% of domestic electricity demand in 2023[17] and as much as 10% from 2026 onwards.[18] Turkey also plans to build two more nuclear power plants in cooperation with Russia[19] in the farther future. Together with Akkuyu, these would provide the country with around a third of its electricity needs. The implementation of these plans could reduce gas consumption and imports.

The social and political costs of gas imports

Despite the infrastructural and contractual conditions that make it possible to fully meet domestic gas demand, the high costs of gas imports have remained a challenge for Turkey this winter. These costs are particularly acute at a time of a severe financial crisis in the country, which has been exacerbated by the policy of subsidising gas (and electricity) prices. The ongoing financial crisis has caused the lira to depreciate; this has led in turn to higher costs of importing gas, whose prices on the European and global markets have recently been high anyway.

The situation is further complicated by the regulations of the domestic gas market. Gas is supplied by the state-owned company BOTAŞ, which is responsible for more than 93% of the country’s imports. It is obliged by law to subsidise the price of gas for households and industrial consumers. According to media reports, subsidies accounted for up to 80% of the gas price last year.[20] In the face of growing problems with the country’s current account deficit, it has become increasingly difficult and costly to maintain this policy over recent months. This meant that in 2022 BOTAŞ was forced to hike gas prices for households by 174% (while keeping the subsidies at 80%), for businesses by 277%, and for large industrial plants by 379%.[21] Removing the subsidies would result in an even greater, several-fold increase in energy prices on the domestic market; that would drive many companies into bankruptcy and make ordinary citizens insolvent. Substantially reducing the subsidies seems unrealistic, especially now that Turkey is facing parliamentary and presidential elections scheduled for 14 May. According to available data, subsidised gas and electricity prices are projected to cost the budget around $32 billion in 2023.[22] This is a trap from which Turkey cannot easily escape. The government is maintaining its policy of subsidising the prices for gas (and energy more generally) for political and social reasons, but also to ensure the stability of the domestic market. At the same time, it is searching for additional funds to finance these subsidies despite its swelling current account deficit. This policy has plunged BOTAŞ into serious financial trouble. In October 2022, its annual debt already stood at 179 billion lira (around $9.6 billion).[23] In comparison, Turkey’s 12-month current account deficit reached $43.5 billion at the time.[24] The 2022/3 winter season has exacerbated these problems, and the rising costs of the government’s gas policy are posing an increasingly serious challenge to the stability and solvency of the state treasury.

Gas cooperation with Russia

The invasion of Ukraine and its consequences for European-Russian relations have increased the importance of energy cooperation with Turkey, including gas cooperation for Russia. This is particularly true as Russia is becoming increasingly isolated from its previously key European partners and customers. Turkey has opted not to join the Western sanctions, as a result of which it emerged as the world’s largest importer of Russian gas in the second half of 2022. Turkey is also becoming a key market for Russian oil and coal, alongside China and India. Its importance for the transit of Russian energy resources to third countries is also growing, which is confirmed by President Vladimir Putin’s proposal to create a Russian-Turkish gas hub on Turkish territory. The details of this project are yet to be worked out; for example, it is not clear whether the Russian side would only seek to increase transit or also to enable Turkey to re-export its gas. It appears that the discussions are primarily political; it is unlikely that any new investments (especially those that require Western involvement, technology or know-how) that could increase Russian gas transit will be implemented while the war continues.[25] However, the ongoing dialogue on the project shows that Turkey’s position is strengthening, both as an outlet and as Russia’s possible future partner in activities on the regional gas market. Putin’s proposal also fits in with Turkey’s strategic goal of creating a gas hub in the country and re-exporting gas to Europe, a project it has been pursuing for two decades.

In the current financial and domestic political situation, the government in Ankara can also temporarily exploit Moscow’s weakness to secure favourable terms to import gas from Russia. The issue of financing gas purchases and subsidising domestic prices remains a very serious challenge for Turkey; hence it has been preparing for the heating season by seeking access to cheaper fuel and looking to extract concessions from Russia on the matter of its gas payments. Firstly, Turkey managed (thanks to Erdoğan’s successive rounds of talks with Putin, among other factors)[26] to secure an agreement to pay for 25% of its gas supplies in roubles, which benefited both partners. From Ankara’s perspective, getting these agreements reduced domestic demand for scarce Western currencies (de-dollarisation), and should also reduce the costs of importing fuel from Russia.[27] However, it appears the currency switch will not bring any significant gain for Turkey, as both the lira and the rouble are highly volatile at present. Nevertheless, the two sides are still planning to increase the percentage of such transactions.[28]

Turkey also wants to secure discounted gas prices from Russia. During negotiations in December 2022, it reportedly sought a discount of more than 25% on the initial price, as well as the deferral of its payment obligations until 2024.[29] According to unconfirmed reports, an agreement on a one-year extension of BOTAŞ’s deadline to repay its debt to Gazprom (amounting to $20 billion) was reached in late December.[30] Talks on price discounts are ongoing. If the Turkish government reached an agreement on this issue, that would allow it to save money ahead of the election campaign (spring 2023), which it could then use to combat the negative effects of inflation (for example, by raising the minimum wage). That in turn would boost the ruling Justice and Development Party (AKP)’s chances of winning the parliamentary and presidential elections.

Cooperation with Europe, and Turkey’s vision of a hub

At the same time, in the short to medium term, Turkey also appears to be a fairly attractive partner for Europe, or at least for the countries in the Balkans and the south of the continent. It has surplus import capacity, a diversified infrastructure, and connections to the European market (interconnectors and the Trans-Balkan gas pipeline), so it could become an important link in the search for alternatives to Russian energy sources and for ways to import these resources. In this way, in addition to Russia’s interest in deepening cooperation and the expanding possibilities of importing Russian fuel, also the needs of the EU itself increase Turkey’s chances of realising its ambition to build a gas hub. This would not necessarily be a hub in the form suggested by Russia, but rather one that Turkey has been striving to create for two decades now, which would allow it to trade gas from all of available sources and re-export it to third countries, including the EU. President Recep Tayyip Erdoğan elaborated further on these plans in mid-December 2022. He said that Turkey’s goal is to quickly become a global gas trading centre at which the reference price for gas is determined. In addition, the country may want to provide European importers with access to the growing capacity of its import infrastructure, including its LNG terminals. The contract between BOTAŞ and Bulgaria’s Bulgargaz signed on 3 January 2023 is the first example of such a deal, as well as a signal that Turkey’s plans may be gradually coming to fruition. This contract provides Bulgaria with access to 1.5 bcm/year of capacity at Turkish LNG terminals (mainly Saros) for 13 years, and guarantees that BOTAŞ will transport gas to the border between the two countries.[31] However, there is no information confirming the signing of an interconnection agreement, which would formally open the way for aligning the terms to transmit gas from Turkey to EU countries.[32] That would most likely require at least a partial reform of the Turkish gas market, and would be crucial for cooperation with Europe, as such reforms would include establishing transparent rules inter alia on access to infrastructure or the opening of a larger gas export corridor from and through Turkey to the West with the use of both Turkish terminals and the Trans-Balkan route. Signs that the AKP may be preparing for such a gas market reform emerged in early March.[33]

In addition to the above, the actual success of Turkey’s plans for a gas hub will also depend on the timing and pace at which they are implemented. The EU will need additional gas volumes and sources over the next few years – after that the demand for gas (and thus for cooperation with Turkey in this field) is expected to fall off, as the process of European energy transition gains traction. It is unclear at this point what the exact role of Russian supplies in Turkey’s vision of a gas hub would be. While the Turkish government could possibly seek to re-export gas from Russia in the future, it now appears that this gas will be increasingly used to meet domestic needs; this would not only be due to the contractual constraints, but even more importantly, also due to a lack of interest from European consumers. Turkey would then be able to offer its surplus import capacity and gas (especially LNG) from other sources to more potential European customers. The EU countries, which are in the midst of an energy war with Russia, would probably demand guarantees from Turkey that it would not resell Russian gas to them. At the same time it cannot be excluded that Turkey, which has been trying to secure more favourable contracts for the supplies of Russian gas, may want to create a situation in which it can mix gas from various sources and sell such a mixture (so-called Turkish blend) further down the line. This would result in closer Russian-Turkish ties – but also, despite the relative improvement in Ankara’s position in its relations with Moscow, lead to Turkey’s increased dependence on Russian gas supplies, which could have political consequences.

As the Turkish government strives to create a gas hub, it is also seeking to develop more gas pipeline connections: with the Caspian region (talks have been held on doubling the capacity of the TANAP pipeline[34] and possibly starting work on gas shipments from Turkmenistan to Turkey and further west)[35] and Iran (an agreement has been signed on building a new gas pipeline and upgrading the old one)[36]. It also wants to strengthen cooperation with Egypt, and potentially even with Israel.[37] In addition, the planned launch of domestic gas production and the prospect of a fall in gas consumption (or at least in the rate at which demand for gas rises) may increase Turkey’s potential to re-export gas.

[17] The first nuclear reactor is scheduled to be commissioned in the second half of 2023.

[20] S. Hacaoglu, F. Kozok, ‘Erdogan sees $32 billion energy subsidies in 2023 election year’, Bloomberg, 17 October 2022, bloomberg.com. Gas prices in January 2023: households: 4.08 lira/m³, industry: 7.12-15.83 lira/m³ (depending on the size of the company), power plants: 18 lira/m³. Data for January 2023. Source: botas.gov.tr.

[27] The details of the agreement are not known. It can be assumed that Turkey and Russia would exchange currencies at a mutually beneficial rate, which would increase the lira’s purchasing power and reduce the costs of importing gas from the Russian Federation.