Turkey – Money Laundering – Farewell To Grey: The FATF Removes Türkiye From The Grey List

Three years ago, Türkiye was included in the grey list

countries that require special scrutiny of the Financial Action

Task Force (“FATF“). This inclusion

posed significant challenges for Türkiye, as being on the FATF

grey list historically restricts cross-border transactions,

complicates its ability to obtain credit, and limits foreign

investment inflows. The listing underscored concerns regarding

Türkiye’s efforts in combating money laundering and

terrorist financing. However, through intense efforts and

comprehensive reforms of government and stakeholders, Türkiye

has made remarkable progress. These reforms included strengthening

legal frameworks, taking adequate measures to address the concerns,

enhancing oversight mechanisms, and improving international

cooperation. In this regard, Türkiye’s possible delisting

from the grey list has been discussed for a while.

A few days ago, Minister of Treasury and Finance Mehmet

Şimşek travelled to Singapore to participate in the FATF

General Assembly meeting. On June 28, 2024, FATF President Raja

Kumar held a press conference to announce the outcomes of the

General Assembly, revealing that Türkiye has been removed from

the grey list1. According to the Plenary, the

decision-making body of the FATF, Turkey has made significant

progress in strengthening its

AML/CFT regime and is no longer subject to the FATF’s

increased monitoring process. This development reflects

Türkiye’s dedication to aligning with international

standards and enhancing the integrity of its financial system.

In this article, we will discuss the significant outcomes of

Türkiye’s removal from the grey list, delving into the

economic and financial implications of this development. We will

also explore how this achievement is crucial for Türkiye,

particularly in terms of boosting foreign investments and enhancing

international trade.

What are the FATF and the Grey List?

The FATF, an independent international organization established

by the G7 countries in 1989, operates at the OECD headquarters in

Paris2. Initially founded with 16 countries, FATF’s

membership has since expanded to include 37 countries and 2

regional organizations (the European Commission and the Gulf

Cooperation Council), totalling 39 entities. Türkiye has been

a member of the FATF since 19913.

The primary objective of FATF is to assess whether member and

non-member countries have implemented necessary measures against

money laundering and terrorist financing. While FATF assessments

are not legally binding, the organization aims to facilitate

coordinated global intervention to combat organized crime,

corruption, and terrorism. This approach generates a quasi-binding

effect among states, non-member states, and regional organizations,

influencing public opinion and promoting global cooperation.

The FATF 40 Recommendations

(“Recommendations“) are pivotal

documents that establish and promote international standards in

combating money laundering and terrorist financing4. The

Recommendations, set a global standard, which countries should

implement through measures adapted to their particular

circumstances. In this regard, the Recommendations have been

globally accepted as international standards for combating money

laundering and terrorism financing.

Moreover, FATF publishes two lists namely the grey list and the

blacklist. A country’s placement on the black or grey list is

determined by its adherence to these Recommendations. These lists

are updated three times annually. Countries that fail to comply

with the recommendations are placed on the blacklist, while those

showing partial compliance are placed on the grey list. Being

listed signifies that the country has not taken sufficient measures

to combat money laundering and terrorism financing, leading to its

designation as an unreliable country in the international financial

markets.

In detail, countries on the blacklist are identified by FATF as

“jurisdictions subject to a call for action due to

high-risk areas for money laundering, terrorist financing, and

financing of proliferation activities with serious strategic

deficiencies“5. FATF member countries are

called upon to take measures and actions against these countries to

safeguard the international financial system. Currently, the

blacklist includes three countries: Iran, North Korea, and

Myanmar.

On the other hand, the grey list, termed “jurisdictions

under increased (strict) monitoring” identifies countries

actively collaborating with FATF to address strategic deficiencies

in their regimes against the financing of terrorism and

proliferation6. Placing a jurisdiction under increased

monitoring by FATF signifies that the country has committed to

swiftly resolving identified strategic deficiencies within

specified timeframes while being subject to enhanced scrutiny

during this period. Until its removal, Türkiye was on the grey

list along with Bulgaria, Burkina Faso, Cameroon, Croatia, the

Democratic Republic of Congo, Haiti, Jamaica, Kenya, Mali,

Mozambique, Namibia, Nigeria, Philippines, Senegal, South Africa,

South Sudan, Syria, Tanzania, Vietnam, and Yemen7.

However, Türkiye has successfully been delisted from the list

on June 28, 2024.

Türkiye’s Removal from the Grey List

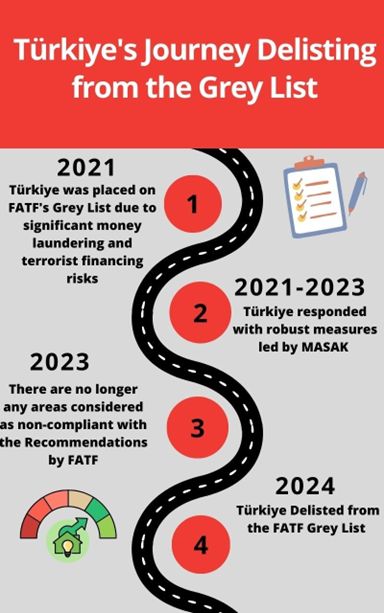

In October 2021, FATF announced Türkiye’s inclusion on

the grey list by publishing the ‘Jurisdictions under

Increased Monitoring‘ list8. According to this

monitoring report, Türkiye was found to be compliant with 11

out of 40 recommendations, largely compliant with 20, partially

compliant with 7, and non-compliant with 29. The FATF

highlighted significant money laundering risks in Türkiye,

attributed primarily to activities such as drug trafficking,

migrant smuggling, human trafficking, and fuel smuggling,

influenced by its geographical location10. Moreover,

FATF underscored significant risks of terrorist financing in

Türkiye, originating from both domestic and international

sources11.

In response to these challenges, the Turkish Financial Crimes

Investigation Board (Mali Suçları

Araştırma Kurulu -

“MASAK“) implemented a series of robust

measures aimed at strengthening the country’s AML/CFT regime

upon thoroughly assessing the Türkiye’s current situation

against the AML/CFT risks. These measures included enhancing the

regulatory framework, increasing the number and quality of

inspections, and providing extensive training for financial

institutions to ensure compliance with international standards.

Following these efforts, FATF released a new report named

“Follow-up Report & Technical Compliance

Re-Rating” (“Follow-Up

Report“) in June 202312. According to the

Follow-Up Report, there are no longer any areas considered as

non-compliant with the Recommendations. Under this Report,

Türkiye was assessed as largely compliant with 25

recommendations and compliant with 14 recommendations. Only one

Recommendation numbered 15 “New Technologies“

was partially compatible. In this regard, Türkiye has taken a

step towards this Recommendation and

regulated crypto assets, which have become very popular as an

investment and payment instrument in recent years, as crypto assets

are favourable for use in money laundering or terrorism

financing.

Minister Mehmet Şimşek played a vital role in this

process. In numerous statements, Şimşek emphasized the

government’s unwavering commitment to addressing the FATF’s

concerns and restoring confidence in Türkiye’s financial

system and stated that Türkiye has “substantially

completed” the necessary steps to be removed from its

grey list. He also highlighted the significant progress made in

recent years, noting that Türkiye had implemented a

comprehensive action plan that addressed all of the

Recommendations.

What’s next: The potential implications of the removal

Removal from the FATF grey list is of great importance,

especially for international reputation and foreign investments.

Being on the grey list had created a perception of higher risk

among international investors, leading them to be cautious and

hesitant to invest in Türkiye.

The removal of Türkiye from the FATF grey list would have

significant implications for the country, particularly in terms of

international investment and economic activities. Concurrently,

many international investment funds are restricted from investing

in countries on the grey list due to legal regulations. As

Türkiye is removed from the grey list, these funds will be

able to invest in Türkiye, potentially increasing foreign

direct investment and stimulating economic growth. Delisting will

increase the investors’ confidence to Turkish market. Indeed,

many investors consider a country’s status on the Grey List

before making investments. Hence, being on the Grey List also a

crucial role in due diligence processes and can sometimes be a

decisive deal breaker. In this sense, this removal could lead to

improved access to capital for businesses operating within

Türkiye, fostering expansion opportunities and job

creation.

Moreover, being on the grey list imposes various restrictions on

cross-border transactions and makes it more challenging to obtain

credit. Financial institutions in grey-listed countries often face

higher scrutiny and stricter compliance requirements, which can

limit their access to international financial networks and increase

transaction costs. Therefore, delisting from the grey list would

alleviate some of these burdens for Turkish businesses and

financial institutions, facilitating smoother cross-border

transactions and potentially reducing borrowing costs.

Another side of the coin, being on the grey list severely

affects a country’s reputation and perception among

international investors and business partners. Indeed, being on the

grey list of the FATF signal concerns about a country’s

commitment to combating money laundering and terrorist financing,

which in turn deters potential investors and affects the overall

business environment. Therefore, removal from the Grey List

demonstrates that Türkiye has implemented adequate measures to

combat money laundering and terrorism financing, significantly

enhancing its international reputation. This milestone reflects the

country’s commitment to financial transparency and regulatory

compliance, restores confidence among foreign investors, and

international partners of its stable and secure financial

environment.

Conclusion

Removal from the Grey List should not be underestimated as a

matter of prestige. It notably positions Türkiye as a

preferred partner in international financial collaborations by

instilling confidence in foreign financial institutions and

investors. Beyond prestige, delisting from the grey list is crucial

for projecting an image of an economy where rules are enforced and

efforts for AML/CFT are effectively managed. Lastly, delisting the

Grey List also signifies the cessation of increased monitoring

process by FATF.

As a result, Türkiye’s delisting from the FATF grey

list marks a significant milestone for the country’s economy

and financial system. The steps taken during this process not only

facilitated Türkiye’s delisting from the grey list but

will also strengthen its financial infrastructure, positioning it

more competitively on the international stage. This milestone not

only signifies Türkiye’s commitment to global financial

standards but also opens new avenues for economic growth and

stability. Moving forward, Türkiye is expected to maintain its

compliance with these standards, supporting the sustainable growth

of its economy.

We wish for the continuation of Türkiye’s progress in

combating money laundering and terrorism financing.

Footnotes

1. FATF,

Last Accessed: 28.06.2024.

2. History of FATF,

, Last Accessed: 28.06.2024.

3. Please see.

4. FATF,

Last Accessed: 27.06.2024.

5. FATF,

Last accessed on 27.06.2024.

6. FATF,

Last accessed on 28.06.2024.

7. FATF,

Last accessed on 28.06.2024.

8. FATF,

Last accessed on 28.06.2024.

9. FATF,

Last accessed on 28.06.2024.

10. FATF,

Last accessed on 26.06.2024.

11. FATF,

Last accessed on 26.06.2024.

12. FATF,

Last Accessed: 27.06.2024.

The content of this article is intended to provide a general

guide to the subject matter. Specialist advice should be sought

about your specific circumstances.