Thomson Reuters to acquire tax automation company SurePrep for $500M

Thomson Reuters has announced plans to acquire SurePrep, a tax automation software company based in Irvine, California.

The transaction, which Thomson Reuters said it expects to close in Q1 2023, values SurePrep at $500 million, which will be paid entirely in cash.

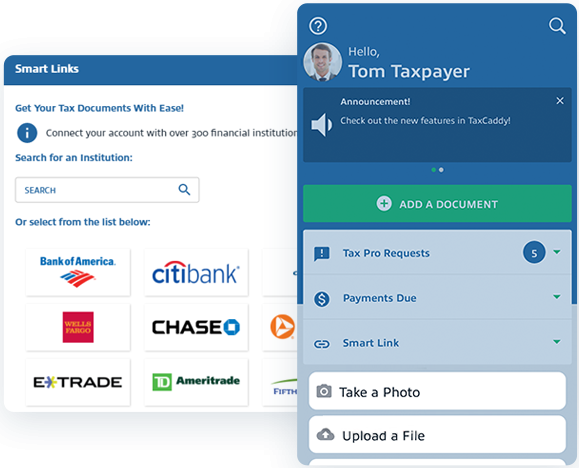

Founded in 2002, SurePrep is one of numerous software providers that help tax professionals and accountants gather and file 1040 tax returns on behalf of their clients. Integrating with existing tax software systems, SurePrep offers various products that support uploading documents at regular intervals through the year via automated document requests, with support for mobile scanning, esignatures, and more. Built-in AI smarts also automatically extracts and repopulates data in companies’ tax compliance software of choice, removing many of the manual paperwork steps involved.

SurePrep’s TaxCaddy product

SurePrep is the latest in a long recent line of tax management software companies to be acquired. In August, Vista Equity Partners announced plans to acquire automated tax compliance company Avalara for $8.4 billion, while earlier this month private equity firm Cinven revealed it was buying online tax preparation software provider TaxAct for $720 million. Last year, Stripe bought TaxJar for an undisclosed amount.

Thomson Reuters, though perhaps best known for its news agency, has a number of business units including legal, government, and tax and accounting. Indeed, it has been partnering with SurePrep for the past six months, according to Thomson Reuters, “providing complementary solutions” for tax and accounting workers — this has effectively meant Thomson Reuters serving as a reseller for SurePrep’s software.

For SurePrep, the deal will give it extensive reach into Thomson Reuters’ existing customer base, while for Thomson Reuters it gets an arsenal of automated tools to bolster its existing tax products.