Robinhood banks on retirement to slow user attrition

Retail trading app Robinhood is entering the retirement game.

The Menlo Park, California-based company today launched a waitlist for its new offering, Robinhood Retirement, which it describes as the “first and only” individual retirement account (IRA) with a 1% match on every eligible dollar contributed.

The move is a big bet on the part of the fintech giant that the traditional 9-to-5 employee is no longer the norm. It is targeting gig workers and contractors, for example, who have historically found it challenging to save for retirement without the benefit of a full-time job and access to an employer-sponsored plan.

In an interview with TechCrunch, CEO and co-founder Vladimir “Vlad” Tenev said Robinhood is addressing the current trend away from a single employer model:

There are a lot of people who are contractors or who are working multiple jobs that don’t have access to a traditional safety net pension plan or 401(k)s with a match. Employer-sponsored 401(k)s are a really huge force behind getting people to save for retirement. But not everyone is privileged enough to be eligible for one – either they don’t have full-time employment or if the day, their employer is too small or doesn’t offer a match…We’re building this for them.

The company has “been thinking about what a retirement product could be for Robinhood for a while,” Tenev added, saying the new offering is representative of the company’s focus on expanding products “to meet customers at every stage of their financial journey.” Earlier this year, for example, it also rolled out stock lending and a cash card.

The retail investment behemoth’s plan to diversify isn’t shocking, considering the turbulent year it has had in terms of both its stock and the company’s performance. (It was also previewed earlier this year.)

In early August, Robinhood slashed 23% of its workforce just three months after it cut 9% of full-time staff in two rounds of layoffs that were believed to have impacted some 1,000 workers. Also in early August, Robinhood was slapped with a $30 million fine by a New York financial regulator, specifically on its cryptocurrency trading arm.

Robinhood’s stock price has been volatile over the past year, as well. Shares closed down 3.2% at $9.67 on December 5, down from a 52-week high of $23.74.

To get the product up and running as soon as possible, Robinhood is inviting anyone with an existing Robinhood account or who is eligible to create a Robinhood account — meaning they are 18 and over and meet other standard criteria — to join the waitlist. (Waitlisting users is a move that Robinhood has used numerous times, including with its crypto product, to both build buzz and ensure a smoother experience for users as they are moved past the figurative velvet rope.)

Robinhood doesn’t charge any fees to maintain an account and says the retirement accounts will have “zero commissions or account minimums,” but that “other fees may apply (referring to any current fees in the company’s fee schedule).

Users will have one login to access both their primary investing and retirement accounts.

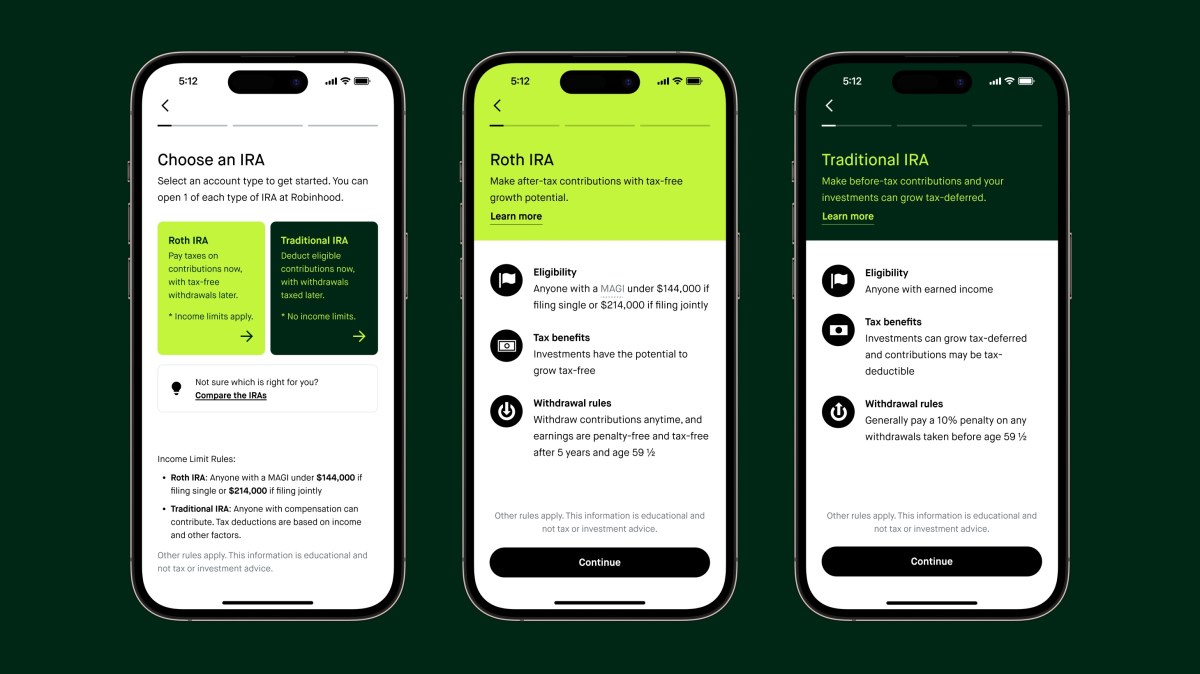

Historically, Robinhood has been the target of lawsuits and criticism that it wasn’t doing enough to educate its client base about what they were doing with their money. To head off similar criticism with this new product, the company is taking early steps to provide what Tenev described as in-app guidance, education and guardrails for users.

“A lot of the regulatory backdrop on what makes an IRA different and unique is unclear and opaque . . .” said Tenev. “So we want to make sure that people are not putting money in the wrong way, or taking it out the wrong way, without being fully aware of the tax penalties.”

The plan is for the bulk of customers to be onboarded by the end of January, so that those who are interested in making a contribution can do so before filing taxes. Meanwhile, users who are “really excited to use it early” will get an instant access option — but only if they refer someone, even existing Robinhood customers, to the waitlist using their referral code, said Sam Nordstrom, Robinhood’s manager of product management.

Once onboarded, users will have the choice of investing in stocks and ETFs through either a traditional IRA or a Roth IRA, says Robinhood. Customers can build a “custom” portfolio through “tailored” in-app recommendations or by choosing their own investments — or a mix of both. They also can earn interest on cash stock lending.

Adding to its bottom line

Robinhood needs the product to work. It reported losing 1.8 million monthly active users over the three-month period, a quarterly decrease of 12.8% to 12.2 million, “the lowest level since it listed as a publicly traded company,” according to Yahoo News.

On a positive note, in early November, Robinhood reported third-quarter financials that beat revenue and earnings estimates mainly due to higher interest earned from rising rates. Specifically, it notched revenue of $361 million on a net loss of $175 million, or 20 cents diluted earnings per share versus expectations of $357.7 million on expectations of 27 cents diluted earnings per share.

It’s easy to see how retirement accounts could quickly add to its bottom line. Robinhood has several revenue streams, including through subscriptions via a “Gold” product. But much of the money it makes from its taxable brokerage accounts is through payment for order flow, a controversial practice that last year, the Securities & Exchange Commission threatened to ban, before reversing course this fall.

Layering retirement accounts into the mix will only increase the amount of orders flowing through its platform. Indeed, the expectation is that Robinhood will see a “a significant increase in assets on the platform, and activity, over time,” Tenev says.

Robinhood is also banking on the fact that there are plenty of Gen Z and millennials who are interested in retirement but have not yet started amassing assets toward that end. And it’s hoping to entice them to do so during a down market.

The decision to add a retirement offering, the company claims, is in part based on customer feedback of the desire to have “all their financial investment accounts in one place,” according to Tenev.

“We’re building a product home for all your money,” Tenev said.

TechCrunch’s weekly fintech newsletter, The Interchange, launched on May 1! Sign up here to get it in your inbox.

Got a news tip or inside information about a topic we covered? We’d love to hear from you. You can reach me at [email protected]. Or you can drop us a note at [email protected]. If you prefer to remain anonymous, click here to contact us, which includes SecureDrop (instructions here) and various encrypted messaging apps.