Reliance-Disney India media merger to control 85% of streaming, half of TV audience | TechCrunch

The merger of Indian media assets of Reliance, its portfolio Viacom18 and Disney will create an entity that captures 85% of the country’s on-demand streaming service audience and about half of the TV viewers, analysts said, posing bigger challenges to Netflix, Amazon’s Prime Video, Apple, Sony and Zee.

The merger, which is scheduled to complete by March of 2025, will have exclusive digital and broadcast rights to some of the key sporting events – including the next four years of popular cricket tournament IPL, flagship ICC events, domestic Indian cricket, FIFA World Cup, Premier League, and Wimbledon.

Cricket match streaming has been the prime driver of new users for streaming platforms in India. By securing numerous cricket rights, Disney and JioCinema have left rival services with minimal content options to attract fans.

“The combined new entity captures both digital and TV rights of key cricket sporting events in India, like IPL and ICC matches,” Morgan Stanley analysts wrote in a note Thursday.

“The 2023-27 IPL broadcasting now sit under the JV – Viacom 18 has digital streaming rights (won for US$2.9bn) while Star has TV broadcasting rights for US$2.8bn. In the IPL 2023, JioCinema streamed matches free for all users, which impacted Hotstar’s earnings. However, with the JV structure, we could see significantly better profitability.”

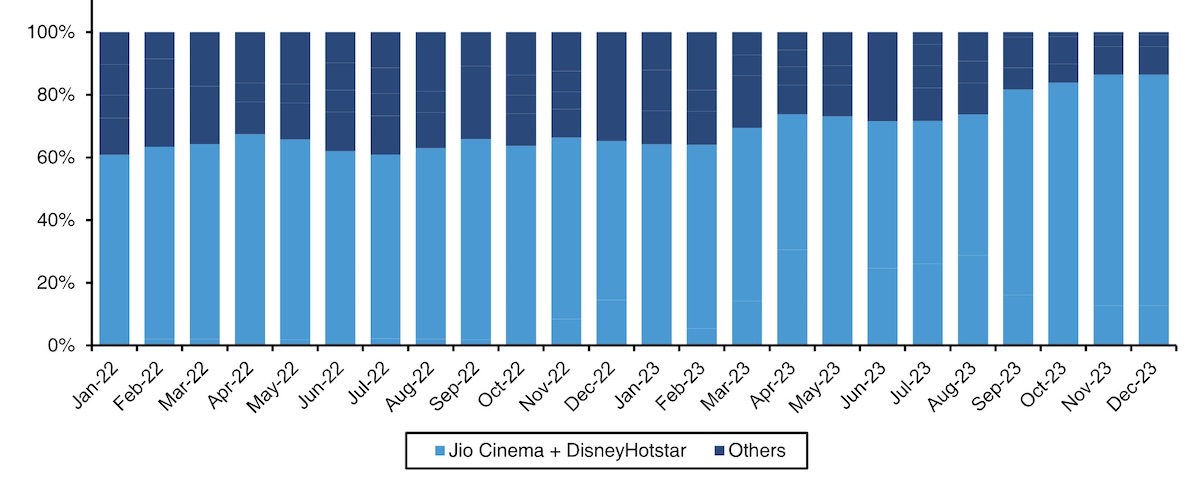

Data and image: Bernstein

The merged unit will also have exclusive India access to Disney’s movies and productions as well as the mouse company’s wide catalog of 30,000 content, the two firms said. It will also be the digital home for content from HBO, Warner Bros, Showtime and NBCUniversal.

Bernstein analysts estimated that the combined operations of Disney’s Hotstar and JioCinema will have a market leadership within India OTT with about 85% monthly active OTT user base.

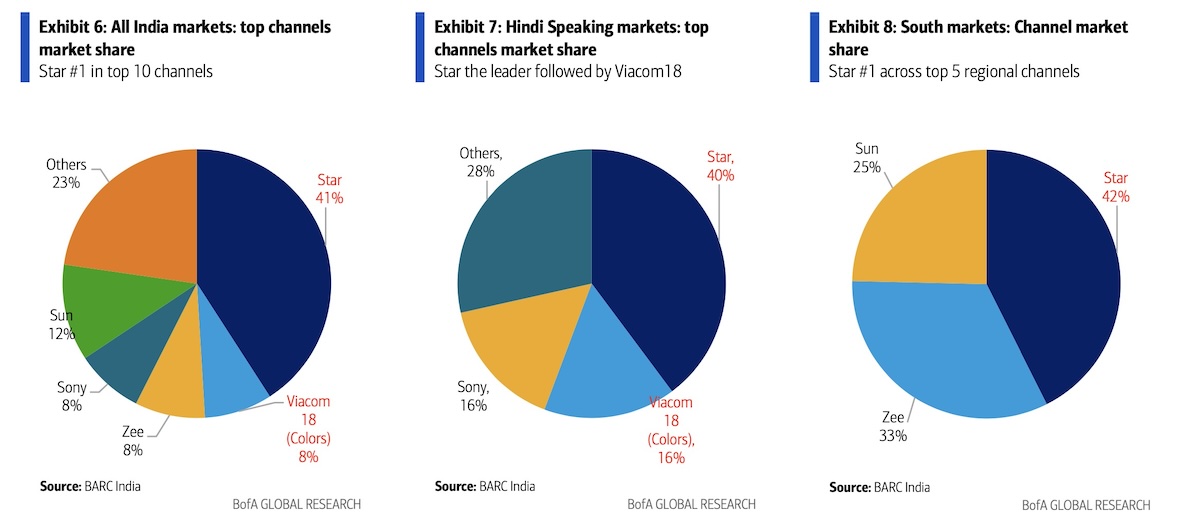

Data, image: BofA

Star, part of Disney’s India property, commands 41% of the broadcast market in India. Combined with about 8% of the TV market that Viacom18 assumes in India, the merged operations — which will feature over a 100 TV channels — will command about 49% of the broadcasting market.

The two firms will command 56% of the Hindi-speaking TV audience in the country, according to an analysis by Bank of America analysts.