Malaysia Can Make Advances In Islamic Finance In Turkiye – BusinessToday

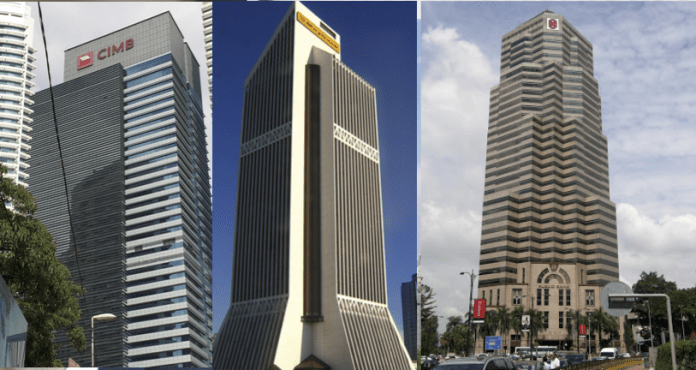

By: Pravin PeriasamyThe growing interest in Islamic banking operations among consumers has created a transformative paradigm shift in the capital markets. There is a growing demand to cater to the interests of the global Muslim community who, by virtue of their religious and ideological commitments, prefer sharia-compliant banking and financial services which are committed to the incorporation Quranic fundamentals in their commercial operations over those of a more conventional nature, i.e. ‘western’-oriented banks. The rationale for this preference is inherently rooted in the perception that Islamic banks possess a ‘moral and ethical superiority’ in its prohibition of usury, speculation, and its advocacy of ethical financing. The infrastructural scaffold of Islamic banking in Malaysia has, in recent times, successfully supported the establishment of sharia-compliant banks, typically extensions of pre-existing banks, which meet the demands of the local populace and has successfully produced leading players in Islamic finance and banking such as that of Maybank and CIMB Islamic.

The efficaciousness of an Islamic financial institution’s expansion in foreign markets is contingent, among other things, on consumer receptivity. The cultural implications of such an expansion ought to be registered and factored in as the beliefs, values, traditions, and customs of the target demographic signifies consumer behaviours and preferences. These behaviours and preferences gauge the potential, with regard to the extent to which consumers are inclined towards product offerings and services, of commercial success. A ruptured disconnect between an institution’s operations and consumer preferences could result in a systematic failure to exert an influential capture of the market, rendering a firm’s ability to impact consumer decision-making obsolete. Within the context of Islamic banking and finance in Malaysia, the consumer demand for such products and services arises because of the religious obligations and duties of Muslims who are psychologically-oriented towards the comprehensive fulfilment of the Islamic way of life. What this necessitate therefore is the integration of pre-existing commercial systems, i.e. the banking sector, within Islamic consumer spaces which comply with sharia and Quranic regulations to satisfy the moral demands of the Muslim populace.

This has achieved greater viability, in recent times, the success of which may be attributed to the increasing number of established Islamic financial institutions globally which secure the conviction of the Muslim consumer; empowering them to trust that deviation from the conventional—Western-oriented—banks is feasible. A report initiated by Mambu—a fintech company—found that 77% of Malaysian respondents aged 16 to 40 utilized Islamic banking services and emphasized the importance of accessible Islamic banking. The millennial and Gen Z Muslim population accounts for most Islamic banking users in Malaysia, indicating the successional and continual interest in such services from prior generations; signalling expectant long-term growth in the Islamic finance industry.

Among the many causal conditions for Türkiye’s improved economic growth is its ‘youthful demographic profile,’ with 27% of the local population falling under the Generation Z category. The ever-expanding market of young consumers in Turkey has led to the constructive development of key industries, with banking products and services garnering elevated consumer demand. Islamic banks have gained prominence in Turkey, enjoying an increase from 8210 branches in 2019 to 8473 in 2020. These developments when viewed considering the forecast projections from the Participation Banks Association of Turkey which outlines a 15% increase in market demand for Islamic banking and the increase of Islamic banking assets from 1.08% in 2001 to 7.1% in 2020 strengthens the case for a hypothesized expansion of Malaysian Islamic banking in Türkiye. Emerging markets, such as Türkiye, have been found to experience heightened levels of ‘socially responsible consumption,’ with consumer behavioural trends demonstrating growing inclinations for ethical business and environments.

Türkiye’s emerging market serves as a conducive and fertile environment for Malaysian Islamic banking to cater to the Turkish Islamically-oriented banking and financing palette through its product and service offerings and capitalize upon Türkiye’s growth potential.

A subsequent rationale for an expansion in Türkiye is the growing institutional disillusionment with the state of conventional banking systems which are perceived to be regressing into a state of moral decline. In May 2024, President of Türkiye Recep Tayyip Erdoğan, speaking at the International Arab Banking Summit in Istanbul, lamented the failure of international financial systems to account for widespread social injustice and economic inequities spurred by prejudiced mechanisms deeply entrenched within these financial systems, and proactively advocated for the increased adoption of Islamic banking and finance to act as a sustainable, morally superior alternative. The shift within the collective Turkish consciousness towards ethical and morally superior financial systems as a reactionary response to conventional institutions—disassociated from important moral commitments, irreconcilable with the faith-based commitments of Muslim devotees—with is evident of institutional receptivity towards Islamic financial firms intending on establishing a market presence in Türkiye.

The author is the Networking and Partnership Director at Malaysian Philosophy Society