Lawmaker blasts Big Oil CEOs at hearing: ‘You are ripping off the American people’

None of the executives agreed to do so.

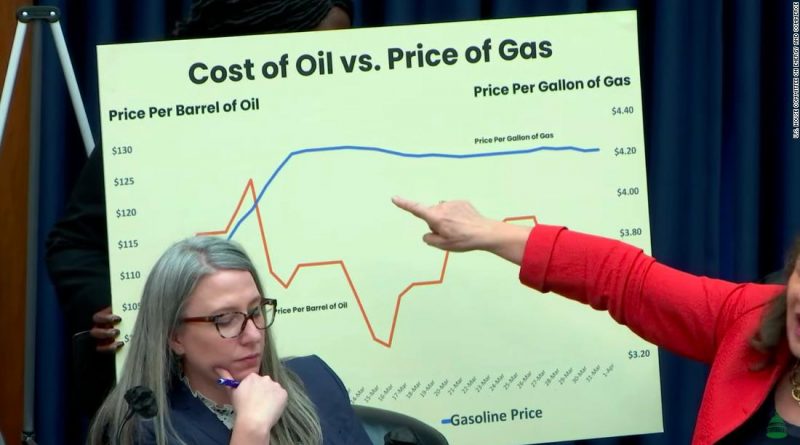

US oil production remains below pre-Covid levels, even as oil prices have nearly doubled.

Lawmakers fired back with strong complaints, suggesting that the executives should be squarely focused on shareholders, particularly during the war in Ukraine.

“Gas prices cannot continue to be dependent on the whims of autocrats like Putin who can weaponize oil against us,” Ruiz said.

Pallone, meanwhile, said oil companies are devoting $45 billion in share buybacks plus another $40 billion in dividends.

“That’s a lot of money to shareholders, but it’s coming at the expense of the American people, who need you to increase production, not shareholder wealth,” Pallone said. “For the American people to have relief from high gas prices your companies need to do their part and increase production to meet demand.”

But it’s not that simple, Sheffield said during the hearing. He noted that the oil industry is facing challenges like many other sectors: worker shortages, a lack of supplies and price spikes, all of which have slowed its ability to boost production.

“We are seeing severe supply constraints. We are lacking a lot of equipment. The reason we can’t grow faster is we are lacking rigs,” Sheffield said. “We are seeing severe inflation…and we will continue to see severe inflation over the next several years.”

The Pioneer CEO added that companies are struggling to hire workers, echoing concerns voiced by other industries.

“Who wants to come back and work in the oil and gas industry? We can’t get people back,” Sheffield said, noting that the 2020 oil crash was the latest in a series of downturns in the boom-to-bust industry.

Cutting ties with Russia

Democratic New York Rep. Paul Tonko criticized oil-and-gas companies for investments in Russia since Moscow annexed Crimea in 2014, arguing those projects have “helped to fund Putin’s war chest.”

“It’s rather complex because we are operating offshore rigs in deep waters and environmentally sensitive areas,” Woods said during the hearing. “We are working our way through that as expeditiously as possible.”

Asked if Exxon’s investments in Russia are in the best interests of the United States, the CEO cited bipartisan support over the years for those ties.

“Both Democratic and Republican administrations have encouraged our investments as a way to bring Western values into Russia and benefit the Russian people,” Woods said.

Wirth, the Chevron CEO, was asked to commit to terminating all operations in Russia — including supplying Russian companies with lubricants and other materials.

“We’ve halted all those sales, and for the foreseeable future, there is no way those will resume,” Wirth said.

Lawler of BP America said that within 96 hours of the invasion, his company announced its intention to exit its stake in the Russian oil giant Rosneft, taking a writedown of up to $25 billion.

“BP was horrified with the military action in the war against Ukraine,” Lawler said. “The company is quite serious about our response.”

Watkins said Shell is moving as “fast as we possibly can” to fully divest from Russia.