India’s electric two-wheeler sales hit a speed bump

In India’s bustling streets, where two-wheelers are seen as the primary mode of transportation, a powerful shift toward electrification has been underway. Fossil fuels still dominate the South Asian nation’s automotive industry, but a shift towards EVs — particularly in the two-wheeler category — is underway. More than 1.3 million electric two-wheelers have been sold to date, putting the country on track for its goal of 80% electric two- and three-wheelers in the next seven years.

However, this promising trajectory has encountered an unexpected roadblock. Electric scooter sales have taken a hit, and the blame falls squarely on the recent reduction of government subsidies. The fallout may include market consolidation and even exits of some players.

In May, the Indian government revised its incentive scheme called Faster Adoption and Manufacturing of (Hybrid and) Electric Vehicles, commonly called FAME-II, and reduced subsidies to $122 (10,000 Indian rupees) per kWh of battery capacity, with a maximum cap of 15% of the ex-factory vehicle price. Previously, the incentive was $183 (15,000 Indian rupees) per kWh for up to 40% of the vehicle price.

Customers purchasing eligible vehicles receive a discount as part of the incentive scheme, and the government later reimburses the manufacturers for the price reduction.

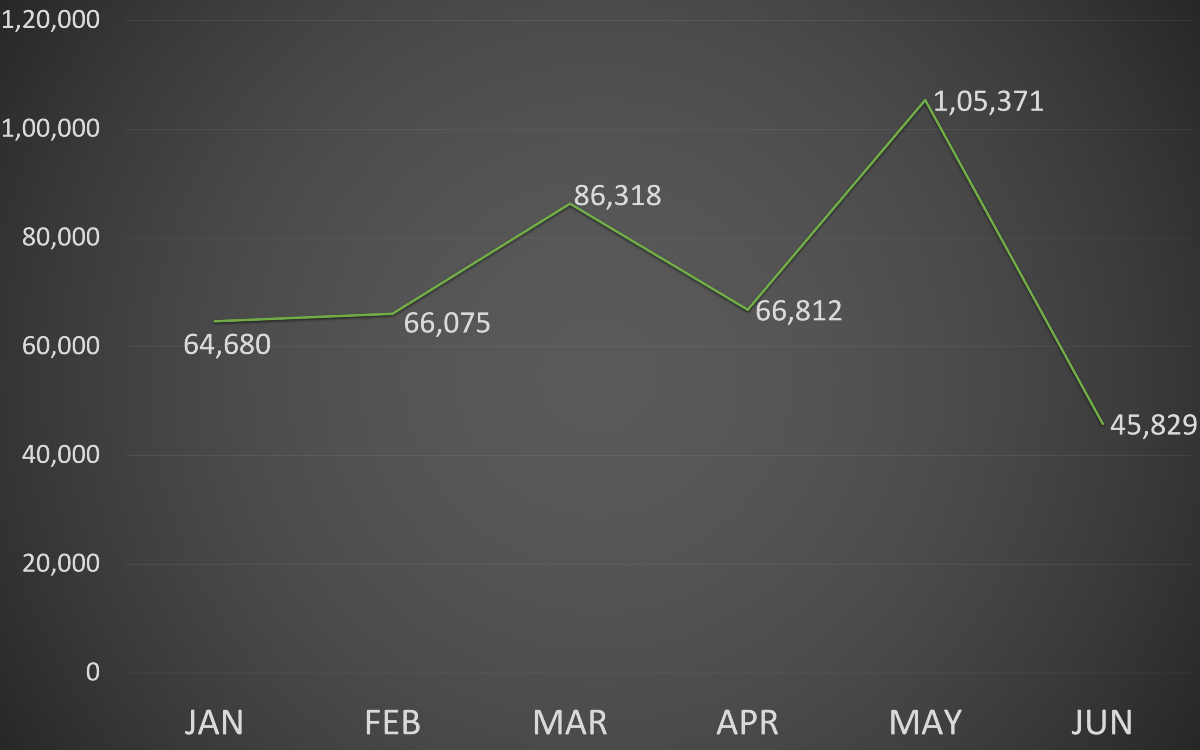

The changes in the scheme resulted in a sudden disruption in the electric two-wheeler market in India, as their sales witnessed a significant decline in June, dropping more than 56% to 45,829 units compared to 105,371 units in May, according to the recent data from the government’s Vahan portal. Although May experienced higher sales due to customers anticipating price increases after the revised scheme, June marked the lowest sales month of the year. In fact, June’s sales dipped below the levels seen in any of the last six months of 2022.

Came into effect from June 1, the updated scheme applies to most electric two-wheelers in India, excluding those priced above $1,800, which are not eligible for the subsidy.

The catalyst

India’s electric two-wheeler sales between January and June 2023, per the data provided by Vahan Image Credits: Jagmeet Singh / TechCrunch

Sources say the change came as sales of subsidized electric two-wheelers crossed the million-unit mark faster than expected. The Ministry of Heavy Industries announced the FAME-II policy in April 2019, with an initial runtime of three years until March 2022, but was later extended to up to March 31, 2024. The scheme carries a total subsidy outlay of $1.2 billion, including $244 million specifically for electric two-wheelers. The latter was depleted due to growing sales of electric scooters.

“Because of the faster pace of growth, the money would have run out two months back. So, instead of stopping the subsidy, the government decided to reduce the subsidy level per vehicle,” a person familiar with the development told TechCrunch.

Before the latest update, the government provided a subsidy of about $550 to $670 per vehicle, based on the vehicle specifications. That’s come down to about $255, pushing manufacturers to increase the prices of most of their models and eventually started impacting their sales.

India currently has 135 players in the electric two-wheeler segment, which had 100 participants in 2022, per the Vahan portal.

“No EV player at this point is profitable, and nobody is making enough money so as to absorb [the revised subsidy’s impact],” Ravneet S Phokela, the chief business officer of Ather Energy, told TechCrunch.

The Tiger Global and Caladium Investment-backed startup, which is one of the top-three electric two-wheeler makers in the country in terms of sales, increased the pricing of its scooters by about $100.

Similar to Ather Energy, SoftBank-invested Ola Electric, the leading electric two-wheeler player in the Indian market, as well as legacy two-wheeler makers, including TVS Motor, raised the prices of their electric scooters to pass a part of the subsidy reduction to riders. Newer entrants such as River, which recently raised $15 million in a funding round led by Dubai’s Al Futtaim Group, have also planned price hikes for their newly launched scooters.

‘Not favorable to support EV adoption’

The Society of Manufacturers of Electric Vehicles (SMEV), an industry body for EVs in the country, considers that the updated incentives hinder the local electric two-wheeler development and has urged the government to revise its approach.

“A glitch at the very beginning is not a favorable way to support EV adoption, and we believe a correction is necessary now,” said Sohinder Gill, director general at SMEV and CEO of Hero Electric.

Similarly, Atul Jairaj, a partner at Deloitte India, emphasized that the revised subsidy regime creates immediate anxieties for sellers and buyers alike since the market is yet to achieve price parity between EV and ICE vehicles.

“With this move, the impetus is more on the manufacturers to drive costs and prices down, which, though it may take time, could eventually drive self-sufficiency in the sector. However, it is important to continue to support the sector through other means (e.g., driving infrastructure growth). Keeping consumer confidence actively high will be key to continued higher adoption,” he told TechCrunch.

Some market watchers believe that manufacturers need to find ways to keep the pricing of their models competitive against ICE-packed vehicles to stay relevant in the market.

“Ultimately, the manufacturers have to build their business models without subsidies, and we see this as a gradual reduction of the subsidies, without risking a sudden withdrawal, giving time to manufacturers to adjust accordingly,” Kunal Khattar, founding partner at AdvantEdge, told TechCrunch.

Khattar, who closely watches the overall automobile sector in India and has some investments in the Indian EV startup space, speculates that while the reduction in the subsidy has impacted monthly volumes, sales will likely pick up as the higher prices become the new normal. High fuel prices will also help drive EV sales.

“Total cost of ownership for EVs continues to be favorable even with reduced subsidies,” Khattar said.

An investigation was also recently launched in response to complaints about certain manufacturers exploiting the incentive policy. As a result, New Delhi mandated scooter makers to include chargers with their vehicles, a component that was previously sold separately. The government also instructed manufacturers to reimburse customers for charger expenses incurred until April 13.

Phokela said Ather Energy has set aside $18 million to refund customers for chargers upon request.

According to the data shared by Hong Kong-based Counterpoint Research with TechCrunch, the share of EVs in the overall two-wheeler market in India grew to 6% in the first quarter of 2023 from 0.2% in 2020. However, the country aims to achieve 80% sales of electric two-wheelers and three-wheelers — alongside 30% sales of passenger electric vehicles and 70% sales of electrified commercial vehicles — by 2030.

Electric two-wheeler share in the overall Indian two-wheeler market, per Counterpoint Research Image Credits: Jagmeet Singh / TechCrunch

Abhik Mukherjee, a research analyst at Counterpoint Research, told TechCrunch that the decrease in subsidies during the early stages of EV adoption in the country would likely decrease the EV usage rate.

“In order to ensure the achievement of India’s ambitious EV targets, it is strongly recommended that some form of subsidy remains in place until at least 2027,” he said.

The analyst also pointed out that long-term subsidies in China and tax credits in the United States have contributed to the EV market growth in their respective countries.

Outcomes of the sudden disruption

The fall in sales due to the price hike is expected to bring various modifications within the electric two-wheeler market in India. One of the most obvious changes is the shift in customer focus from the widely selling high-speed electric scooters to options including low-speed vehicles, which are so far most considered for commercial use cases in the country.

Khattar of AdvantEdge said that while low-speed two-wheelers were more popular before the FAME-II scheme was introduced, the market shifted to high-speed options as the price difference between the two segments contracted due to heavy subsidies available with the latter.

In the financial year 2023, nearly 200,000 low-speed electric two-wheelers, while their high-speed counterparts reached 780,000, the investor said.

Experts including Khattar also believe that the increase in the pricing of electric two-wheelers in the country would shift market share toward legacy brands and full-stack manufacturers.

Manufacturers are also expected to innovate their pricing strategies by offering new financial schemes, pay-per-use models and exploring ways to separate the ownership of vehicles and batteries, Khattar noted.

Similarly, some consolidation and shutdowns would likely happen in the market, as not all players could sustain themselves due to poor sales.

Arpit Agarwal, an investment partner at Blume Ventures, told TechCrunch that some industry players relying on imported kits and lacking R&D efforts may struggle without significant subsidies and increasing demand. He predicts that only 30 to 40 manufacturers will survive, with newer companies likely capturing a majority of the market share, while legacy players could lose their position.

Kaushik Burman, general manager and managing director of Gogoro India, told TechCrunch that the market consolidation would be a positive way for customers as it will result in more reliable, durable and safe products being offered to them.

“Investments in the EV infrastructure space will not halt,” he said.

Alongside consolidation, the market is expected to go through some battery-side changes as the government’s subsidy is primarily linked with batteries of two-wheelers.

Ather Energy’s Phokela told TechCrunch that the average battery size would come down due to the revised incentive.

“In the subsidy regime, if you built a bigger battery, you also got a subsidy. So, you don’t really care how big the battery was,” he said. “Now, with the subsidy coming down, it is no longer the case… so what’s going to happen now is that manufacturers will start looking at what is the genuinely right size of the battery for scooters as opposed to saying let us build big ones because we are getting money from the government.”

Swappable batteries in Indian electric two-wheelers are expected to gain some traction. Startups such as Tiger Global and Blume Ventures-backed Battery Smart and Bosch and MFV Partners-invested Sun Mobility, as well as international players like Gogoro from Taiwan, are investing in building a swappable battery infrastructure. These investments are likely to contribute to the growth of the overall EV ecosystem in India. However, the government is still in the process of finalizing its draft battery-swapping policy, which was released in April last year.

One of Gogoro’s battery swapping stations Image Credits: Gogoro

Sources told TechCrunch that industry stakeholders are engaged in discussions with the government to propose FAME-III, as manufacturers continue to seek incentives to attract customers. There are also talks about modifying the production-linked incentive (PLI) scheme to provide incentives for local manufacturing of vehicles. The government has already allocated over $3 billion to incentivize local production of electric and hydrogen-fuel-cell vehicles and components, primarily for large-scale automobile companies and upcoming manufacturers. However, ongoing discussions aim to include existing players, including EV startups, in the scheme to allow them to avail incentives for their production.

The Ministry of Heavy Industries did not respond to a request for comment on how it is seeing the impact and planning to assist the industry.

EV startups in India have raised a total of $3.8 billion in equity rounds since January 2020, according to the data from market intelligence firm Tracxn shared with TechCrunch. Of this, $1.5 billion were raised by startups developing electric two-wheelers. Funding in the EV market has grown significantly from $265.3 million in 2020 to $1.9 billion in 2022. Despite the ongoing slowdown in VC funding, EV startups still received $824.3 million in investments in 2023, with electric two-wheeler startups alone raising $405.6 million of that amount.

Khattar said electric two-wheelers are expected to account for over 75% of the overall two-wheeler market volume by the financial year 2030, with their sales volume to exceed 20 million units.