How to land investors who fund game-changing companies

A lot of problems worth solving aren’t ones that you can solve in a year or two or even 10.

For founders and investors alike, such long timelines can seem daunting. But for Gene Berdichevsky, co-founder and CEO of battery tech startup Sila, hard tech problems are also some of the most tantalizing.

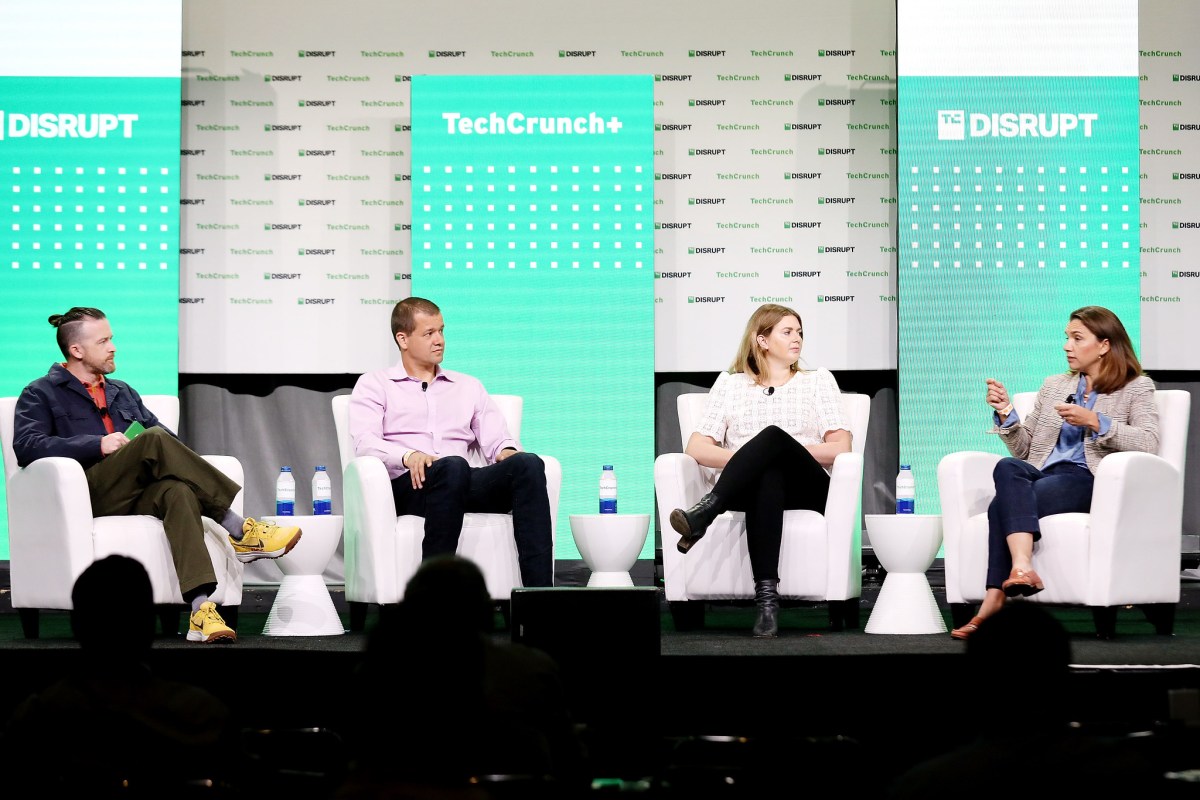

“It’s always a good time to be a hard tech startup,” Berdichevsky said at TechCrunch Disrupt. “One of the reasons is that the world doesn’t change just because it should. It changes because someone goes after something insanely hard and actually succeeds at it.”

Such hard.tech startups run the gamut from advanced batteries like those made by Sila to nuclear fusion, quantum computing, automation and robotics. Any tech that has the potential for such broad impact also has a massive potential market, and that means a certain class of investors are willing to be in it for the long haul.

“Hire people to do the technical stuff. Keep an eye on it, but then go learn the other pieces.” Gene Berdichevsky, co-founder and CEO, Sila

“We look for real step-change, game-changing technologies that are going to benefit everyone and we think that will drive a huge [total addressable market],” said Milo Werner, a general partner at The Engine.

When Berdichevsky founded Sila, he believed his company’s technology, a silicon-based anode that promises to improve lithium-ion battery energy density by 20%–40%, would be a significant enough advance that it would have no problem finding a market.

What he didn’t expect was how long it would take. When Sila’s first product debuted inside the Whoop 4.0 wearable last year, the path to market had been twice as long as Berdichevsky had expected.