Brazil’s Lula honeymoon with investors over before starting

Investors have soured over his public commitment to prioritise social spending over fiscal integrity and delays in naming his economic team.

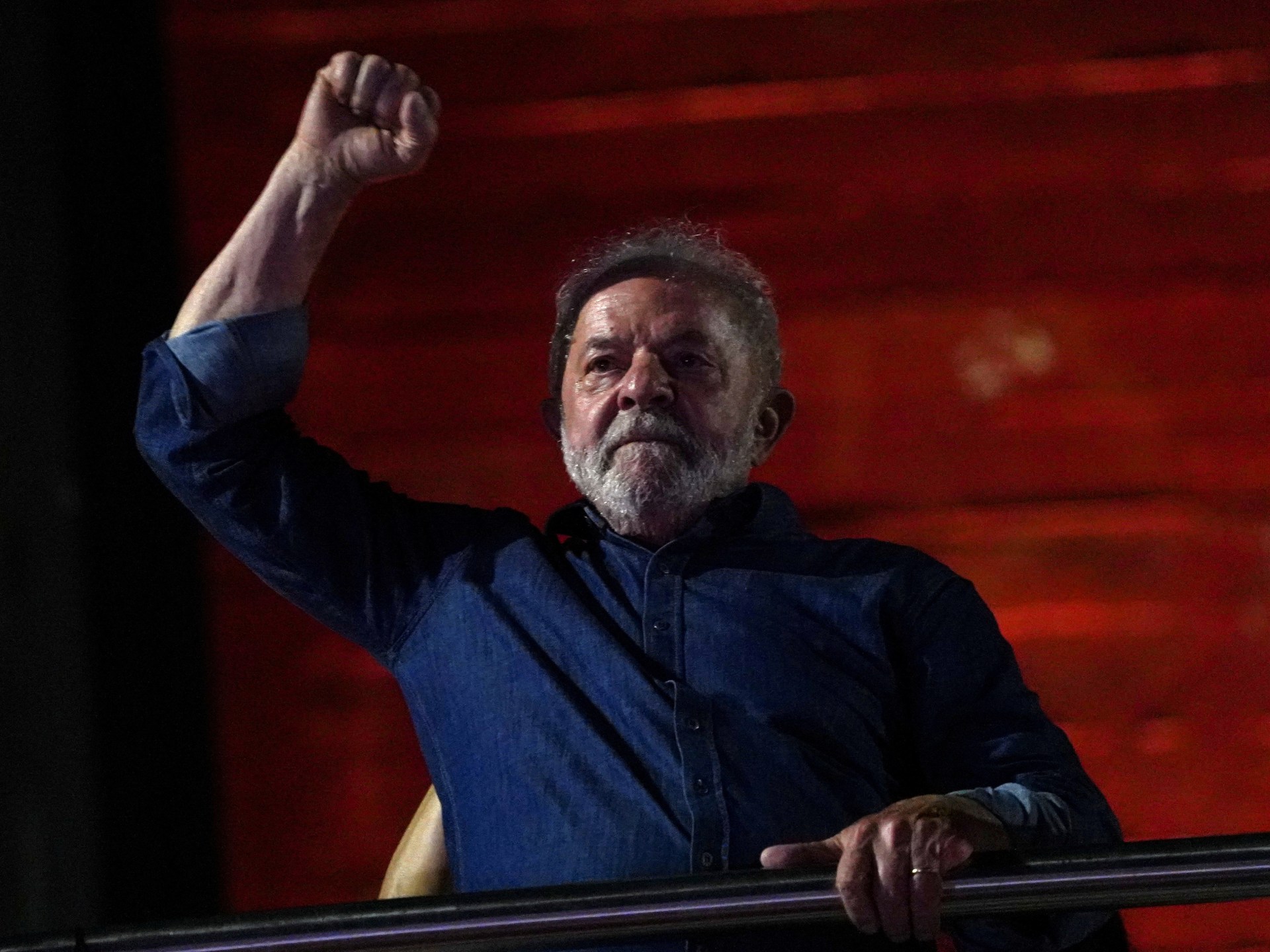

There is growing investor pessimism that Brazilian President-elect Luiz Inacio Lula da Silva will govern with fiscal discipline as the country’s central bank chief likened a market selloff to a “Liz Truss moment for Brazil”.

Brazil’s real currency and Bovespa stock index both lost approximately 4 percent on Thursday, as Lula’s brief honeymoon with investors soured over his public commitment to prioritising social spending over fiscal integrity and delays in naming his economic team.

The Brazilian real clawed back losses on Friday, with the dollar closing the session down 1.24 after a volatile day of trading. Stocks were up more than 2 percent.

Despite those gains, jitters remained, with investors calling for Lula to restore firm rules for public spending after significant outlays by outgoing President Jair Bolsonaro during the pandemic and election campaign.

Central bank chief Roberto Campos Neto, speaking at an event in Sao Paulo, said Thursday’s rout was the latest example of markets demanding fiscal discipline amid a challenging global backdrop of high inflation, low growth and little risk appetite.

“I don’t know if that was a Liz Truss moment for Brazil, but it was a clear demonstration of the markets’ sensitivity to the fiscal issue,” Campos Neto said, referring to the former United Kingdom prime minister who resigned after the markets punished her push for unfunded tax cuts.

Citigroup Inc said in a report that investors may have been mistaken in thinking Lula would pursue an orthodox fiscal agenda, adding that the bank had decided to cut its risk exposure to Brazil in the face of this reassessment.

“The market seemed to have convinced itself that Lula would be fiscally orthodox. The most recent news now casts doubt on this hypothesis,” Dirk Willer, Citi Research’s head of emerging markets strategy, wrote on Thursday night.

Milton Maluhy Filho, the chief executive of Brazil’s largest lender Itau Unibanco ITUB4.SA, said on Friday a balance needed to be struck between social spending and putting public finances in order.

“We think that fiscal responsibility and social responsibility should go hand in hand,” he said in a conference call.

Investors and even Lula allies have also expressed concern about delays in naming his finance minister. Lula has said he will only name his cabinet once he returns from the COP27 climate summit in Egypt.

Senator Simone Tebet, of the centrist Brazilian Democratic Movement party, said the finance minister should be Lula’s first cabinet pick to make clear what his economic policies are going to be.

“A finance minister is needed to explain the president’s political thought,” Tebet told reporters.

On Thursday, Lula sought to downplay investors’ concerns. “The market is nervous for nothing. I have never seen a market as sensitive as ours,” said the president-elect, who takes office on January 1.