Big tech companies in the spotlight as South Africa investigates dominance abuse – TechCrunch

Big tech companies are facing increased scrutiny in South Africa for dominance abuse and anti-competitive behavior, just months after the country’s competition regulator, the Competition Commission (CompCom), started an inquiry into the conduct of online intermediation (b2c) platforms.

In its initial findings, the regulator has established that Apple, Google, UberEats, Airbnb, Booking.com, and South Africa’s Mr Delivery; a food ordering and delivery platform, Takealot; an e-commerce site, Private Property and Property24; both real estate classifieds, and car classifieds Autotrader and Cars.co.za; have an unfair advantage as market leaders, and are operating in ways that impede competition.

The inquiry team is seeking further evidence, if any, from parties affected by the “competition…conduct or market feature” of these platforms. It is also seeking comments regarding findings in the report, as it moves into the final phase of the inquiry, which will include remedial action.

Google and Apple

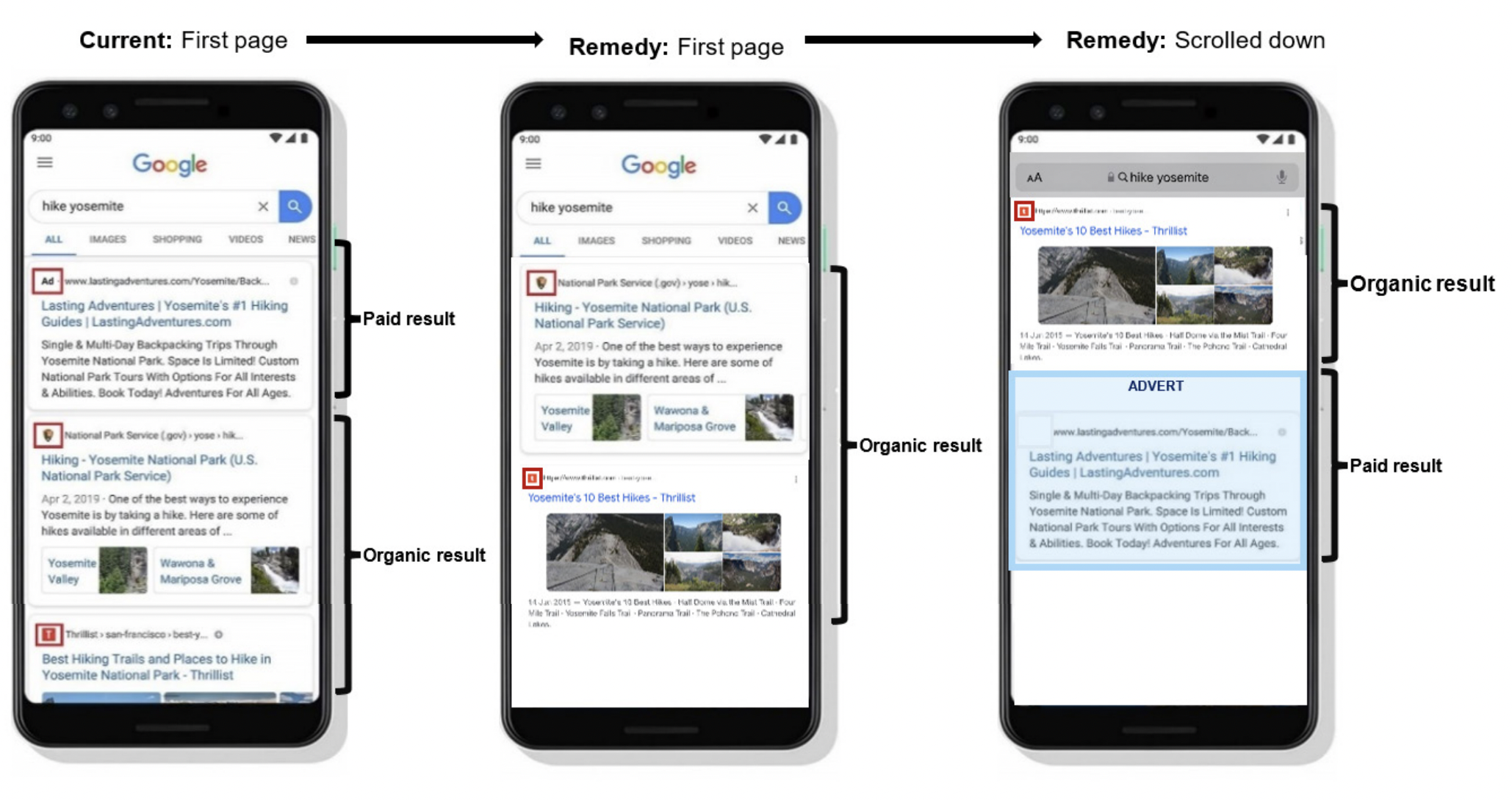

Noting Google’s monopoly, the regulator stated the default positioning of its search engine on android and iOS mobile devices was problematic. The study also took issue with the prominence of paid search results (those that appear at the top of the page), indicating a lack of clear distinction from organic search findings.

The report recommended that the top search results be organically generated, adverts distinctly shaded or labeled, and paid results positioned at the bottom of the results page.

Illustration of the proposed Google search remedy on mobile device. Image Credits: South Africa Competition Commission

It further called for an end to Google’s preference for its own specialist (shopping, travel and local) search tools, saying that they bar competition from aggregators, comparator sites and online travel agencies.

“Google must afford competing metasearch or specialist search (including travel, local and other), comparator sites (shopping or other) and online travel agents the same opportunity to provide content and visual rich impressions or units that it affords its own specialist shopping, travel and local search units. Google may no longer impose minimum bid thresholds for paid results,” CompCom said in its provisional remedies.

It also recommended “an end to default arrangements for Google Search on iOS and Android devices sold in South Africa.”

In-app stores, it noted, “complete exclusion of competing software app stores and side-loading by Apple which impedes effective competition for commission fees.” The default arrangements of Google Play on android devices, the Commission said, has affected competition from other android software app stores.

The regulator also fingered the Google Play Points loyalty scheme, which it says, is funded by extracting discounts from app developers, a strategy it found to hinder competition from smaller players.

“A lack of competition has resulted in excessive commission fees to the detriment of South African app developers, publishers and consumers of apps acquired through the SA storefront requiring in-app payments,”

“…given that Apple will not allow competition and refuses to compromise on security, and Google Play has become entrenched, there needs to be a remedy that either regulates these platforms or successfully takes transactions off the stores altogether so they cannot be monitored and taxed. For this reason, the Inquiry is of the view that either there is price regulation or a complete end to anti-steering provisions which were recommended by the court in the Epic-Apple case,” said CompCom in the report.

In its provisional recommendations, the Commission called for an end to anti-steering provisions for all apps and fronted the end of exclusionary loyalty schemes, as well as the default arrangement of the Google Play store on android devices.

“In terms of an end to anti-steering provisions, the inquiry expects that this would involve the ability for apps to communicate an alternative external payment mechanism and provide a clickable link to make a payment.”

Food delivery platforms

CompCom also recommended an end to the restrictions imposed on franchisees by international restaurant chains, especially in the selection of food delivery partners. Other suggestions included the removal of price parity clauses (which require suppliers not to offer better or lower prices in other or their own platforms) from contracts, end of predatory pricing, and for transparency with consumers – especially on the surcharges for each restaurant.

Additionally, it proposed the removal and prohibition of price parity clauses used by travel and accommodation platforms, Booking.com and Airbnb, which were found to impede competition through lower commissions and prices that in turn increase consumer dependency.

These platforms were also found to leverage “important visibility on their platform” to get discounts from accommodation and travel providers to fund their own loyalty schemes. CompCom found the practice unfair to small players that cannot leverage the same. It went on to recommend the removal of exclusionary loyalty schemes, saying such programs should be fully-funded by the companies.

E-commerce and classifieds

E-commerce platforms were found to stifle competition as they disincentivized sellers from price differentiation across platforms and distorted pricing in the market through subsidization. CompCom suggested that Takealot, a market leader, removes price parity clauses and end predatory conduct, “or alternatively the Commission to consider investigation and prosecution of predatory conduct as a suitable deterrent.”

For listing platforms, the inquiry faulted the lack of interoperability of the listing engine software used by South Africa’s top classifieds platforms (Property24, Private Property, Autotrader and Cars.co.za) impeded competition. Interoperability and the scrapping of fees, to include third-party listing platforms were recommended.