As Australia votes, cost of living a key concern

Hobart, Australia – Penny-pinching is a way of life for Australian David Jobling. The Adelaide man lives in public housing, suffers from chronic pain and survives on a disability pension of 450 Australian dollars ($316) per week.

But with the cost of living rising, he is starting to feel the panic set in.

Even though he is accustomed to living on a tiny income, the 60-year-old actor and writer by training is not sure his budget can stretch any further.

“I’ve done my research in terms of what I can do within my limits,” Jobling told Al Jazeera, adding there is “not a lot of incentive” to do the occasional casual work he picks up because it reduces the value of his pension payments. “But prices are rising, and it’s scary.”

He’s not alone.

Ahead of Australia’s federal election on Saturday, the cost of living has become a pivotal issue for voters. Nearly half of Australians are more worried about their ability to make ends meet than they were a year ago, with young people, women and low-income earners the most concerned, according to an opinion poll released last month.

Even wealthy Australians appear worried, as rising prices and sinking stock markets gnaw away at investment portfolios and newspapers aimed at well-to-do professionals run articles with tips on stopping inflation and “getting away with your wealth”.

Australia’s inflation rate hit 5.1 percent during the first quarter, driven by soaring costs of food, housing, education and transport. Although not as severe as in the United States or the United Kingdom – where inflation is running at 8.3 percent and 9 percent, respectively – the figure marked the steepest rise in prices in more than two decades.

House prices rose especially sharply, surging a record 18.1 percent in 2021/22 – although there are some signs the market could be near the peak.

With the average house in Sydney and Melbourne selling for more than 1 million Australian dollars ($700,000), many young adults are forced to keep living at home with their parents well into their 20s and 30s. Petrol prices in March hit new records, going as high as 2.40 Australian dollars ($1.70) per litre in some parts of the country.

Meanwhile, wage growth has stagnated over the past decade, meaning Australians are paying more with less money in the household budget. In January-March, wages grew by 2.4 percent – less than half the rate of inflation.

The rising cost of living in the “Lucky Country” has hit hard in a nation accustomed to continually rising living standards after 31 years of economic growth that was only interrupted when the pandemic hit.

Despite the cost of living dominating the election campaign, both the incumbent Liberal-National Coalition and centre-left Labor Party have faced criticism for not offering enough to alleviate the pain.

While Prime Minister Scott Morrison has campaigned for weeks on cost of living issues, rolling out excise tax cuts and a scheme to allow first home buyers to tap into their retirement savings, he has largely blamed overseas events such as the war in Ukraine for the financial squeeze.

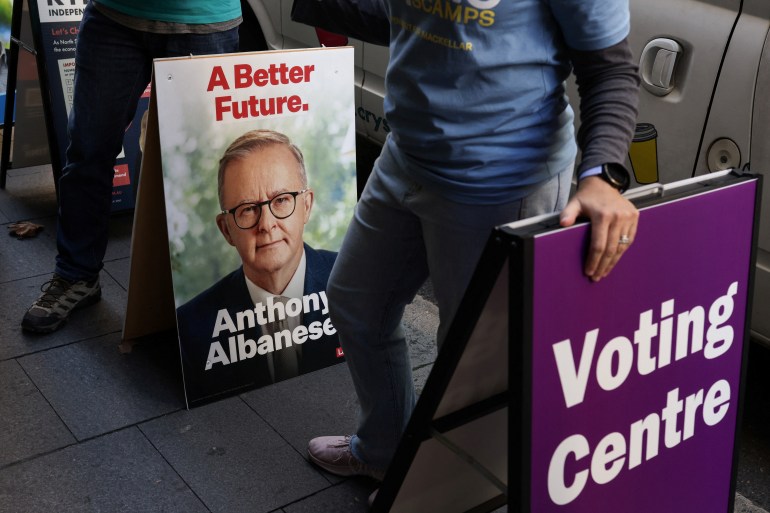

Opposition Leader Anthony Albanese has been criticised for offering little detail about how households would be better off overall under Labor’s plans to address the growing cost of living.

The centrepiece of Labor’s manifesto is a scheme under which the government would pay up to 40 percent of the cost of a new home. The ‘Help to Buy’ scheme would be available for up to 10,000 homes a year.

The two parties are running neck and neck, after Labor’s substantial lead narrowed in recent days.

Rising interest rates to tame inflation are also adding to the squeeze, spurring higher mortgage repayments for millions of Australians.

Claire Victory, national president of the St Vincent de Paul Society, said politicians should take “urgent action” to support Australians living in or at risk of falling into poverty.

“Interest rate hikes will add to these pressures and disproportionately impact the most vulnerable people in the community, who are already struggling to get by, often with limited family or social support networks,” Victory told Al Jazeera.

The worst is likely yet to come, with Australians warned that inflation will continue to rise this year and possibly the next.

Michael Kodari, the CEO of Kodari Securities, said Australians could take comfort in knowing the soaring prices are unlikely to be a long term problem.

“As it was born from the aftershock of the pandemic, this period of inflation is not a sign of a chronic situation and will likely resolve itself in time,” Kodari told Al Jazeera.

In the meantime, Australians like Jobling, who is not a fan of either major party and is considering voting for the minor Australian Greens, are hunkering down.

“I know what I’ve got available to spend right down to the cent every single day and I just cannot go over that,” he said.